What is ELSS Mutual Fund — Complete Beginner's Guide

What is ELSS Mutual Fund: Complete Beginner's Guide

Quick Insights

• ELSS mutual funds are equity based tax saving mutual funds under Section 80C.

• Investors can claim tax deduction up to ₹1.5 lakh per financial year.

• ELSS has the shortest lock in period of three years among tax saving options.

• These funds invest mainly in equities for long term wealth creation.

• Investors can invest through SIP or lumpsum depending on financial goals.

What is ELSS Mutual Fund: Complete Beginner's Guide

Tax saving and wealth creation are two goals that many investors try to achieve at the same time. In India, one investment option that helps achieve both objectives is the ELSS mutual fund.

Equity Linked Saving Scheme, commonly called ELSS, is a mutual fund category that allows investors to claim tax deductions while participating in the growth potential of the stock market.

For beginners who are starting their investment journey, understanding how ELSS works can help in building a tax efficient portfolio.

What is ELSS Mutual Fund

An ELSS mutual fund is a diversified equity mutual fund that primarily invests in stocks and equity related instruments.

These funds qualify for tax deductions under Section 80C of the Income Tax Act, making them a popular tax saving investment option.

Investors can claim deductions of up to ₹1.5 lakh per financial year by investing in ELSS funds.

Unlike traditional tax saving options such as fixed deposits or Public Provident Fund, ELSS funds invest in equities, which means returns depend on stock market performance.

Because of this equity exposure, ELSS funds offer the potential for higher long term returns.

Key Features of ELSS Mutual Funds

Understanding the features of ELSS helps investors decide whether this investment fits their financial goals.

Shortest Lock in Period

ELSS funds have a lock in period of three years, which is the lowest among tax saving investment instruments available under Section 80C.

For example, Public Provident Fund has a lock in of fifteen years and tax saving fixed deposits have a lock in of five years.

This shorter lock in period gives investors relatively better liquidity.

Equity Market Exposure

Since ELSS funds invest mainly in equities, they can benefit from long term growth in the Indian stock market.

Over the past decades, Indian equities have delivered strong long term returns due to economic growth, rising consumption, and corporate earnings expansion.

Professional Fund Management

ELSS funds are managed by professional fund managers who select stocks based on research and market analysis.

This provides diversification and reduces the need for individual investors to analyze every stock themselves.

How ELSS Mutual Funds Work

When you invest in an ELSS fund, your money is pooled with other investors and invested in a diversified portfolio of stocks.

The fund manager may invest across sectors such as banking, IT, consumer goods, pharmaceuticals, or infrastructure.

For example, an ELSS fund portfolio may include shares of large companies, emerging mid cap businesses, and high growth sectors.

The performance of the fund depends on the performance of these underlying stocks.

Investors can invest in ELSS funds through two main methods.

SIP Investment

A Systematic Investment Plan allows investors to invest a fixed amount regularly, such as monthly investments.

This approach helps reduce market timing risk and encourages disciplined investing.

Lumpsum Investment

In lumpsum investing, the investor invests a larger amount at once, usually near the end of the financial year to claim tax benefits.

Both methods are commonly used depending on the investor’s cash flow and financial planning approach.

Tax Benefits of ELSS Funds

The main reason many investors choose ELSS is the tax advantage.

Section 80C Deduction

Investments in ELSS qualify for deduction up to ₹1.5 lakh per year under Section 80C of the Income Tax Act.

This deduction can help reduce taxable income and overall tax liability.

Long Term Capital Gains Tax

After the three year lock in period, profits from ELSS investments are treated as long term capital gains.

Currently, long term capital gains on equities above ₹1 lakh in a financial year are taxed at ten percent.

Despite this tax, ELSS funds remain attractive due to their growth potential and tax deduction benefits.

ELSS vs Other Tax Saving Investments

Investors often compare ELSS funds with other tax saving instruments such as PPF, tax saving fixed deposits, or National Savings Certificate.

Return Potential

ELSS funds offer market linked returns, which may be higher over the long term compared with fixed income products.

Lock in Period

ELSS has a three year lock in period, which is significantly shorter than many other tax saving instruments.

Risk Level

Since ELSS invests in equities, it carries market risk. However, this risk is also the reason why ELSS has the potential to generate higher returns.

Investors with a long term investment horizon often consider ELSS funds as part of their financial planning strategy.

Real Life Example of ELSS Investment

Suppose a salaried professional invests ₹12,500 every month in an ELSS fund through SIP.

Over one year, the total investment becomes ₹1.5 lakh, which qualifies for the full Section 80C tax deduction.

If the equity markets perform well over time, the investor may benefit from both tax savings and capital appreciation.

Many investors use this strategy to combine tax planning with long term wealth creation.

Impact on Indian Financial Markets

ELSS funds play an important role in channeling household savings into the equity markets.

As more investors allocate funds toward ELSS investments, mutual funds receive larger inflows which are then invested in listed companies.

This helps improve liquidity and participation in the Indian capital markets.

Over the past decade, rising awareness about mutual funds and tax efficient investing has increased the popularity of ELSS among retail investors.

Things Investors Should Consider Before Investing

Before investing in ELSS funds, investors should evaluate a few key factors.

Investment Horizon

Although the lock in period is three years, investors should ideally stay invested longer to benefit from equity market growth.

Fund Performance

Comparing historical performance, portfolio composition, and fund manager track record can help identify quality funds.

Risk Tolerance

Since ELSS funds invest in equities, investors should be comfortable with short term market fluctuations.

Conducting proper research is important before making investment decisions.

Platforms that provide research tools and investment insights can help investors analyze options more effectively.

Swastika Investmart, a SEBI registered stock broker, offers research driven insights, technology enabled trading platforms, and investor education resources that help individuals make informed financial decisions.

Frequently Asked Questions

What is ELSS mutual fund?

ELSS mutual funds are equity based tax saving funds that allow investors to claim deductions under Section 80C while investing in the stock market.

What is the lock in period for ELSS?

ELSS funds have a mandatory lock in period of three years from the date of investment.

How much tax deduction can I claim through ELSS?

Investors can claim deductions up to ₹1.5 lakh per financial year under Section 80C.

Can beginners invest in ELSS funds?

Yes, ELSS funds are suitable for beginners who want to start investing in equities while also saving tax.

Are ELSS mutual funds risky?

Since they invest in equities, ELSS funds carry market risk, but they also offer the potential for higher long term returns.

Conclusion

ELSS mutual funds have become one of the most popular tax saving investment options in India because they combine tax benefits with the growth potential of equities.

With a relatively short lock in period, professional fund management, and the ability to invest through SIP or lumpsum, ELSS funds can be a useful addition to many investors’ portfolios.

However, like all equity investments, they require a long term perspective and careful selection of funds.

Investors who want access to research insights, market analysis, and technology driven investment platforms can consider opening an account with Swastika Investmart.

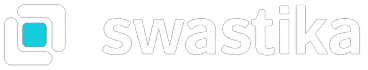

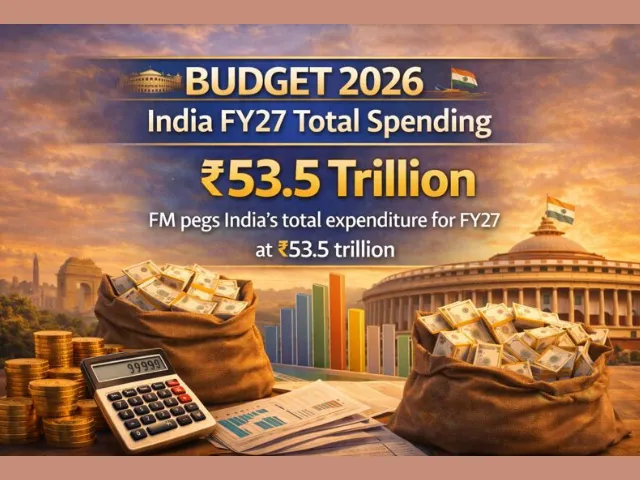

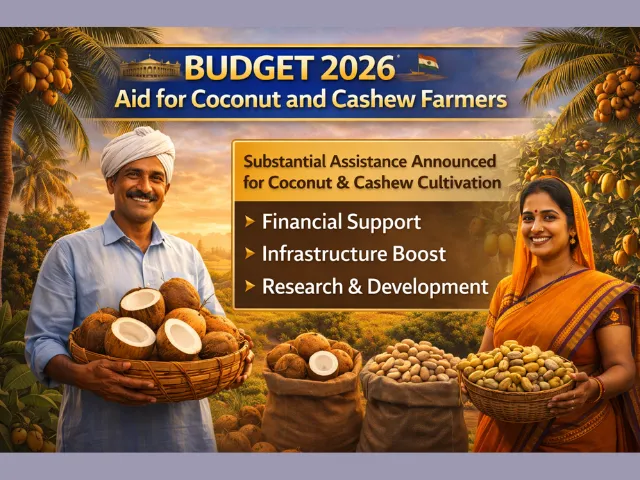

Big Budget

Latest Articles

What is ELSS Mutual Fund — Complete Beginner's Guide

What is ELSS Mutual Fund: Complete Beginner's Guide

Quick Insights

• ELSS mutual funds are equity based tax saving mutual funds under Section 80C.

• Investors can claim tax deduction up to ₹1.5 lakh per financial year.

• ELSS has the shortest lock in period of three years among tax saving options.

• These funds invest mainly in equities for long term wealth creation.

• Investors can invest through SIP or lumpsum depending on financial goals.

What is ELSS Mutual Fund: Complete Beginner's Guide

Tax saving and wealth creation are two goals that many investors try to achieve at the same time. In India, one investment option that helps achieve both objectives is the ELSS mutual fund.

Equity Linked Saving Scheme, commonly called ELSS, is a mutual fund category that allows investors to claim tax deductions while participating in the growth potential of the stock market.

For beginners who are starting their investment journey, understanding how ELSS works can help in building a tax efficient portfolio.

What is ELSS Mutual Fund

An ELSS mutual fund is a diversified equity mutual fund that primarily invests in stocks and equity related instruments.

These funds qualify for tax deductions under Section 80C of the Income Tax Act, making them a popular tax saving investment option.

Investors can claim deductions of up to ₹1.5 lakh per financial year by investing in ELSS funds.

Unlike traditional tax saving options such as fixed deposits or Public Provident Fund, ELSS funds invest in equities, which means returns depend on stock market performance.

Because of this equity exposure, ELSS funds offer the potential for higher long term returns.

Key Features of ELSS Mutual Funds

Understanding the features of ELSS helps investors decide whether this investment fits their financial goals.

Shortest Lock in Period

ELSS funds have a lock in period of three years, which is the lowest among tax saving investment instruments available under Section 80C.

For example, Public Provident Fund has a lock in of fifteen years and tax saving fixed deposits have a lock in of five years.

This shorter lock in period gives investors relatively better liquidity.

Equity Market Exposure

Since ELSS funds invest mainly in equities, they can benefit from long term growth in the Indian stock market.

Over the past decades, Indian equities have delivered strong long term returns due to economic growth, rising consumption, and corporate earnings expansion.

Professional Fund Management

ELSS funds are managed by professional fund managers who select stocks based on research and market analysis.

This provides diversification and reduces the need for individual investors to analyze every stock themselves.

How ELSS Mutual Funds Work

When you invest in an ELSS fund, your money is pooled with other investors and invested in a diversified portfolio of stocks.

The fund manager may invest across sectors such as banking, IT, consumer goods, pharmaceuticals, or infrastructure.

For example, an ELSS fund portfolio may include shares of large companies, emerging mid cap businesses, and high growth sectors.

The performance of the fund depends on the performance of these underlying stocks.

Investors can invest in ELSS funds through two main methods.

SIP Investment

A Systematic Investment Plan allows investors to invest a fixed amount regularly, such as monthly investments.

This approach helps reduce market timing risk and encourages disciplined investing.

Lumpsum Investment

In lumpsum investing, the investor invests a larger amount at once, usually near the end of the financial year to claim tax benefits.

Both methods are commonly used depending on the investor’s cash flow and financial planning approach.

Tax Benefits of ELSS Funds

The main reason many investors choose ELSS is the tax advantage.

Section 80C Deduction

Investments in ELSS qualify for deduction up to ₹1.5 lakh per year under Section 80C of the Income Tax Act.

This deduction can help reduce taxable income and overall tax liability.

Long Term Capital Gains Tax

After the three year lock in period, profits from ELSS investments are treated as long term capital gains.

Currently, long term capital gains on equities above ₹1 lakh in a financial year are taxed at ten percent.

Despite this tax, ELSS funds remain attractive due to their growth potential and tax deduction benefits.

ELSS vs Other Tax Saving Investments

Investors often compare ELSS funds with other tax saving instruments such as PPF, tax saving fixed deposits, or National Savings Certificate.

Return Potential

ELSS funds offer market linked returns, which may be higher over the long term compared with fixed income products.

Lock in Period

ELSS has a three year lock in period, which is significantly shorter than many other tax saving instruments.

Risk Level

Since ELSS invests in equities, it carries market risk. However, this risk is also the reason why ELSS has the potential to generate higher returns.

Investors with a long term investment horizon often consider ELSS funds as part of their financial planning strategy.

Real Life Example of ELSS Investment

Suppose a salaried professional invests ₹12,500 every month in an ELSS fund through SIP.

Over one year, the total investment becomes ₹1.5 lakh, which qualifies for the full Section 80C tax deduction.

If the equity markets perform well over time, the investor may benefit from both tax savings and capital appreciation.

Many investors use this strategy to combine tax planning with long term wealth creation.

Impact on Indian Financial Markets

ELSS funds play an important role in channeling household savings into the equity markets.

As more investors allocate funds toward ELSS investments, mutual funds receive larger inflows which are then invested in listed companies.

This helps improve liquidity and participation in the Indian capital markets.

Over the past decade, rising awareness about mutual funds and tax efficient investing has increased the popularity of ELSS among retail investors.

Things Investors Should Consider Before Investing

Before investing in ELSS funds, investors should evaluate a few key factors.

Investment Horizon

Although the lock in period is three years, investors should ideally stay invested longer to benefit from equity market growth.

Fund Performance

Comparing historical performance, portfolio composition, and fund manager track record can help identify quality funds.

Risk Tolerance

Since ELSS funds invest in equities, investors should be comfortable with short term market fluctuations.

Conducting proper research is important before making investment decisions.

Platforms that provide research tools and investment insights can help investors analyze options more effectively.

Swastika Investmart, a SEBI registered stock broker, offers research driven insights, technology enabled trading platforms, and investor education resources that help individuals make informed financial decisions.

Frequently Asked Questions

What is ELSS mutual fund?

ELSS mutual funds are equity based tax saving funds that allow investors to claim deductions under Section 80C while investing in the stock market.

What is the lock in period for ELSS?

ELSS funds have a mandatory lock in period of three years from the date of investment.

How much tax deduction can I claim through ELSS?

Investors can claim deductions up to ₹1.5 lakh per financial year under Section 80C.

Can beginners invest in ELSS funds?

Yes, ELSS funds are suitable for beginners who want to start investing in equities while also saving tax.

Are ELSS mutual funds risky?

Since they invest in equities, ELSS funds carry market risk, but they also offer the potential for higher long term returns.

Conclusion

ELSS mutual funds have become one of the most popular tax saving investment options in India because they combine tax benefits with the growth potential of equities.

With a relatively short lock in period, professional fund management, and the ability to invest through SIP or lumpsum, ELSS funds can be a useful addition to many investors’ portfolios.

However, like all equity investments, they require a long term perspective and careful selection of funds.

Investors who want access to research insights, market analysis, and technology driven investment platforms can consider opening an account with Swastika Investmart.

SIP in ELSS vs Lumpsum — Which is Better for Tax Saving?

Quick Takeaways

• ELSS funds allow tax deduction up to ₹1.5 lakh under Section 80C.

• SIP in ELSS spreads investment across market cycles and reduces timing risk.

• Lumpsum investing can work well when markets are undervalued.

• ELSS comes with the shortest lock in period among tax saving instruments.

• The right choice depends on income pattern, market outlook, and risk appetite.

SIP in ELSS vs Lumpsum: Which is Better for Tax Saving?

Tax planning is an important part of personal finance in India. Many investors look for options that help reduce tax liability while also creating long term wealth. Equity Linked Saving Schemes, commonly known as ELSS funds, are one of the most popular investment options under Section 80C of the Income Tax Act.

However, investors often face one key question. Should they invest in ELSS through a Systematic Investment Plan or invest the entire amount as a lumpsum?

Understanding the difference between SIP in ELSS vs lumpsum investing can help investors make better decisions for both tax saving and long term wealth creation.

What is ELSS and Why Investors Use It for Tax Saving

Equity Linked Saving Schemes are diversified equity mutual funds that provide tax benefits under Section 80C.

Investors can claim a deduction of up to ₹1.5 lakh per financial year by investing in ELSS funds. Compared with other tax saving options such as PPF, tax saving fixed deposits, or life insurance policies, ELSS funds offer three key advantages.

Shortest Lock in Period

ELSS has a lock in period of only three years, which is the shortest among tax saving investment options.

Equity Market Exposure

Since ELSS funds invest primarily in equities, they offer the potential for higher returns over the long term compared to traditional fixed income tax saving instruments.

Professional Fund Management

ELSS funds are managed by experienced fund managers who invest across sectors and companies.

Because of these features, ELSS funds have become a preferred tax saving option for many salaried and self employed investors.

Understanding SIP in ELSS

A Systematic Investment Plan allows investors to invest a fixed amount regularly in a mutual fund.

For example, instead of investing ₹1.5 lakh at once, an investor may invest ₹12,500 every month in an ELSS fund.

Benefits of SIP in ELSS

Rupee Cost Averaging

Markets move up and down over time. SIP helps investors buy more units when prices are low and fewer units when prices are high.

This averaging effect reduces the risk of investing at the wrong market level.

Disciplined Investing

SIP encourages regular investing and builds financial discipline.

Many investors find it easier to invest smaller amounts monthly rather than a large amount once a year.

Reduced Market Timing Risk

Even experienced investors find it difficult to time the market perfectly. SIP reduces the impact of market timing mistakes.

For investors with regular income such as salaried professionals, SIP in ELSS is often the most practical tax saving strategy.

Understanding Lumpsum Investment in ELSS

In a lumpsum approach, the investor invests the entire amount at once.

For example, an investor may invest ₹1.5 lakh in an ELSS fund before the end of the financial year to claim tax benefits.

Advantages of Lumpsum Investing

Potential for Higher Returns in Bull Markets

If the market is undervalued and enters a strong uptrend, lumpsum investments may generate higher returns because the entire amount participates in the rally.

Simpler Investment Process

Lumpsum investing requires only a single transaction instead of multiple monthly contributions.

However, lumpsum investing comes with higher exposure to market timing risk.

Real Market Example

Consider two investors investing ₹1.5 lakh in an ELSS fund during a volatile market period.

Investor A chooses SIP and invests ₹12,500 monthly. Investor B invests ₹1.5 lakh as a lumpsum.

If the market falls initially and recovers later, the SIP investor benefits from buying units at lower prices during the market decline.

On the other hand, if the market rises immediately after the lumpsum investment, the lumpsum investor may earn higher returns.

This example shows that the performance difference between SIP and lumpsum depends largely on market conditions.

Impact of Market Cycles on Investment Strategy

Indian equity markets have experienced significant volatility in recent years due to global interest rate changes, geopolitical tensions, and economic developments.

Despite short term fluctuations, the long term growth trend of Indian equities remains strong due to factors such as rising consumption, infrastructure spending, and digital transformation.

Because of this long term growth story, ELSS funds continue to attract investors seeking both tax savings and wealth creation.

For investors who are uncertain about short term market direction, SIP provides a balanced approach.

Tax Rules Investors Should Know

ELSS investments qualify for deduction under Section 80C of the Income Tax Act.

Key tax rules include

• Maximum deduction allowed is ₹1.5 lakh per financial year

• Lock in period is three years from the date of each investment

• Long term capital gains above ₹1 lakh are taxed at 10 percent

Since SIP investments are treated as separate investments, each SIP installment has its own three year lock in period.

Understanding these tax rules helps investors plan their investments more effectively.

SIP vs Lumpsum: Which Strategy Works Better?

The choice between SIP in ELSS vs lumpsum depends on the investor’s financial situation.

SIP may be better suited for

• Salaried individuals with regular monthly income

• Investors who want to reduce market timing risk

• Beginners entering the equity market

Lumpsum investment may suit

• Investors with surplus funds available at once

• Individuals investing during market corrections

• Experienced investors with higher risk tolerance

In practice, many investors combine both approaches depending on their cash flow and market outlook.

Why Research Matters Before Choosing Investments

Selecting the right ELSS fund requires careful evaluation of fund performance, portfolio quality, expense ratios, and risk levels.

Retail investors often benefit from professional research and investment tools when making these decisions.

Swastika Investmart, a SEBI registered stock broker, offers technology driven investment platforms, research insights, and dedicated customer support to help investors analyze financial products more effectively.

With investor education initiatives and research backed insights, platforms like Swastika Investmart help investors navigate tax saving and wealth creation strategies with greater confidence.

Frequently Asked Questions

What is the lock in period for ELSS funds?

ELSS funds have a mandatory lock in period of three years from the date of investment.

Can I invest in ELSS through SIP?

Yes, investors can invest in ELSS through a Systematic Investment Plan with monthly contributions.

Is SIP better than lumpsum for ELSS?

SIP helps reduce market timing risk and is suitable for investors with regular income, while lumpsum investments may work better when markets are undervalued.

How much tax deduction can I claim through ELSS?

Investors can claim deductions up to ₹1.5 lakh per financial year under Section 80C.

Are ELSS funds risky?

Since ELSS funds invest in equities, they carry market risk, but they also offer potential for higher long term returns.

Conclusion

When comparing SIP in ELSS vs lumpsum investing, there is no single strategy that works for every investor. The right choice depends on income pattern, market conditions, and personal risk tolerance.

SIP offers a disciplined and less risky approach to investing in equities for tax saving, while lumpsum investing can be beneficial when markets present attractive opportunities.

Regardless of the approach, the key is to stay consistent with long term investing goals and make informed decisions based on research.

Investors looking for reliable research tools, market insights, and a technology driven trading experience can consider opening an account with Swastika Investmart.

JSW Energy Fundamental Analysis 2025 — Buy, Hold or Avoid?

Key Takeaways

• JSW Energy is rapidly expanding in renewable energy and power generation capacity.

• Strong demand for electricity in India supports long term growth prospects.

• Debt levels and aggressive expansion require close monitoring.

• Renewable energy investments could improve future profitability.

• Investors should evaluate valuation and growth visibility before making decisions.

JSW Energy Fundamental Analysis 2025

India’s power sector is entering a transformation phase driven by rising electricity demand, renewable energy adoption, and government policy support. One company that has been actively expanding in this space is JSW Energy.

In this JSW Energy Fundamental Analysis 2025, we evaluate the company’s business model, financial performance, growth strategy, and future prospects to help investors decide whether the stock is worth buying, holding, or avoiding.

Understanding JSW Energy’s Business Model

JSW Energy is part of the well known JSW Group, which has interests in steel, infrastructure, and energy. The company operates in power generation and focuses on both conventional and renewable energy sources.

Its power portfolio includes:

Thermal Power Plants

Coal based plants continue to form a major part of the company’s capacity and help generate stable base load electricity.

Hydropower

Hydropower assets provide clean energy generation and long term operational stability.

Renewable Energy

JSW Energy has been aggressively investing in solar and wind energy projects as part of India’s transition toward clean energy.

India’s power demand has been growing steadily due to industrial expansion, urbanization, and increasing electricity consumption. This structural demand provides a favorable backdrop for power generation companies.

Power Sector Outlook in India

India is one of the fastest growing electricity markets in the world. According to government targets, the country aims to significantly increase renewable energy capacity by 2030.

Several factors are driving this growth:

• Rapid industrialization

• Growth in electric vehicles

• Rising air conditioning demand

• Government focus on renewable energy

Power generation companies that expand capacity and improve operational efficiency may benefit from this long term demand trend.

JSW Energy Financial Performance

A key aspect of any fundamental analysis is evaluating the company’s financial health.

JSW Energy has shown relatively stable revenue growth in recent years as electricity demand improved across India. Its diversified generation portfolio helps maintain steady cash flows.

Revenue Growth

The company has expanded revenue through:

• Increased power generation capacity

• Long term power purchase agreements

• Renewable energy projects

Long term power contracts with utilities and industrial customers provide predictable revenue streams.

Profitability

Profit margins in the power sector depend heavily on fuel costs, plant utilization, and operational efficiency.

JSW Energy has been working to improve efficiency and reduce costs through technology upgrades and renewable capacity additions.

However, investors should note that profitability in the power sector can fluctuate depending on coal prices and regulatory policies.

Debt and Capital Expansion

Large infrastructure businesses such as power generation require significant capital investment.

JSW Energy has been investing heavily to expand its generation capacity. While this supports long term growth, it also increases debt levels.

Higher debt can create risks if:

• Interest rates rise

• Power demand weakens

• Project execution delays occur

Investors should therefore monitor the company’s debt to equity ratio and cash flow generation closely.

Renewable Energy Strategy

One of the most important elements in the JSW Energy Fundamental Analysis 2025 is its renewable energy expansion.

The company has announced ambitious plans to expand solar, wind, and hydro capacity over the coming years.

This strategy aligns with India’s broader clean energy transition.

Renewable energy offers several advantages:

• Lower long term operating costs

• Reduced exposure to fuel price volatility

• Government policy support and incentives

If executed well, this shift could strengthen JSW Energy’s long term competitiveness.

Competitive Landscape

The Indian power sector includes several major listed companies.

Large players such as NTPC, Tata Power, and Adani Power operate extensive power generation portfolios and continue to invest in renewable energy.

Compared with these companies, JSW Energy is still expanding its scale but has shown strong ambition in renewable investments.

Investors evaluating power stocks should compare:

• Generation capacity

• Renewable energy mix

• Financial strength

• Return on capital

Such comparisons help determine whether a company’s valuation is justified.

Valuation Perspective

Valuation is a crucial factor when deciding whether to invest in a stock.

Even strong businesses may deliver limited returns if purchased at excessively high valuations.

Investors typically examine:

• Price to earnings ratio

• Price to book value

• Return on equity

• Earnings growth outlook

If the market prices in overly optimistic expectations, the stock may face consolidation even if the company performs well operationally.

Real World Example of Power Demand Growth

India’s electricity demand has seen consistent growth in recent years. During peak summer months, record power consumption levels have been observed across several states.

Industrial sectors such as steel, cement, and manufacturing require reliable power supply to operate efficiently.

Companies that can deliver stable electricity generation while expanding renewable capacity may benefit from this demand trend.

JSW Energy’s strategy to diversify its generation mix positions it to capture part of this opportunity.

Risks Investors Should Consider

While the long term outlook for the power sector remains positive, investors should also be aware of potential risks.

Regulatory Risks

Power tariffs and environmental regulations are closely monitored by government authorities.

Policy changes can affect profitability and project approvals.

Fuel Price Volatility

Thermal power plants depend on coal and other fuels. Price fluctuations can impact operating margins.

Capital Intensive Industry

Large infrastructure investments require substantial funding. Companies must maintain healthy balance sheets to support expansion.

Why Research Matters Before Investing

Stock market investing requires careful analysis of financial statements, industry trends, and valuation levels.

Retail investors often benefit from research insights provided by professional brokerage firms.

Swastika Investmart, a SEBI registered stock broker, offers research driven market insights, advanced trading platforms, and strong customer support to help investors make informed investment decisions.

Its technology enabled tools and investor education initiatives allow traders and investors to analyze opportunities with greater confidence.

Frequently Asked Questions

What does JSW Energy do?

JSW Energy operates in power generation and produces electricity through thermal, hydro, and renewable energy projects.

Is JSW Energy a renewable energy company?

The company operates both conventional and renewable power assets but is increasingly investing in solar and wind energy.

What are the key growth drivers for JSW Energy?

Rising electricity demand, renewable energy expansion, and long term power purchase agreements are major growth drivers.

What risks should investors consider?

Investors should monitor debt levels, fuel price volatility, regulatory policies, and project execution risks.

Is the power sector a good long term investment in India?

India’s rising electricity demand and energy transition create long term opportunities, but investors must evaluate company fundamentals carefully.

Conclusion

JSW Energy is positioning itself as a growing player in India’s evolving power sector, particularly through its renewable energy expansion strategy.

The company benefits from rising electricity demand and a diversified power generation portfolio. At the same time, investors must consider factors such as debt levels, valuation, and project execution risks before making investment decisions.

A disciplined, research driven approach can help investors identify opportunities while managing risks.

For investors who want access to professional research tools, market insights, and a technology driven trading platform, opening an account with Swastika Investmart can be a valuable step.

Why We Are Avoiding GSP Crop Science IPO — A Data-Driven Analysis

Why We Are Avoiding GSP Crop Science IPO: A Data-Driven Analysis

India’s primary market continues to see a steady flow of IPOs across sectors such as manufacturing, technology, and agrochemicals. While new listings often create excitement among retail investors, not every IPO offers an attractive investment opportunity.

The GSP Crop Science IPO is one such issue that has generated interest among investors due to its presence in the agrochemical sector. However, when we closely analyze the company’s financial performance, valuation metrics, and industry dynamics, several concerns emerge.

In this detailed review, we break down the numbers, compare the company with industry peers, and explain why investors may want to stay cautious about this IPO.

TL;DR

• GSP Crop Science IPO appears expensive compared to industry peers on valuation metrics.

• Profit growth has slowed sharply despite revenue expansion.

• Agrochemical businesses face regulatory, raw material, and commodity cycle risks.

• Based on financial ratios and sector outlook, the IPO may not offer attractive risk-reward.

IPO Snapshot

About GSP Crop Science

GSP Crop Science is a research-driven agrochemical company involved in manufacturing crop protection products such as insecticides, herbicides, fungicides, and plant growth regulators.

The company operates across two key segments:

- Formulations – Finished agrochemical products used directly by farmers.

- Technicals – Concentrated active ingredients that serve as the base for formulations.

Its products are sold across domestic and international markets, targeting agricultural customers who require solutions to improve crop yields and manage pest control.

Over the years, the company has focused on expanding its product portfolio through research and development while strengthening manufacturing capabilities.

Financial Performance

A closer look at the company’s financials reveals a mixed picture.

Revenue growth has been visible, but profitability has deteriorated significantly in recent years.

Revenue Growth

- FY23 Revenue: ₹1,301 crore

- FY24 Revenue: ₹1,158 crore

- FY25 Revenue: ₹1,206 crore

While the business has maintained revenue above the ₹1,000 crore mark, growth has been inconsistent.

Profit Decline

The company’s profit trend is more concerning.

- FY23 Net Profit: ₹81.42 crore

- FY24 Net Profit: ₹55.54 crore

- FY25 Net Profit: ₹17.57 crore

This represents a sharp drop in profitability.

Margins have also contracted.

- EBITDA Margin FY23: 12.61%

- EBITDA Margin FY24: 11.26%

- EBITDA Margin FY25: 6.74%

Declining margins often signal cost pressures, pricing competition, or operational inefficiencies. For investors evaluating IPOs, weakening profitability is a major red flag.

Valuation Concerns

The biggest concern with the IPO lies in its valuation.

Based on FY25 earnings, the company is expected to list at a Price to Earnings ratio of about 15.34 times.

At first glance, this may appear cheaper compared to some listed agrochemical companies.

However, the issue is that the earnings base itself has declined sharply. When profits fall dramatically, even moderate valuations can become risky.

Peer Comparison

When compared with listed agrochemical companies, the valuation appears stretched relative to growth prospects.

For example:

- PI Industries trades at around 28 times earnings

- Sumitomo Chemical India around 39 times

- Bharat Rasayan roughly 4 times

- Excel Industries about 13 times

However, many of these companies have stronger profitability, better margins, or established export networks.

In contrast, GSP Crop Science currently faces declining margins and volatile earnings.

Therefore, the valuation does not provide a sufficient margin of safety.

Industry Risks

The agrochemical industry has strong long-term potential due to rising food demand and the need to improve crop productivity. However, it also comes with structural risks.

Regulatory Challenges

Crop protection products require approvals from multiple regulatory authorities in India and international markets. Any delays or restrictions can impact product launches and sales.

Raw Material Volatility

Many agrochemical inputs are derived from chemical intermediates. Fluctuations in raw material prices can directly impact operating margins.

Agricultural Cycles

The sector is closely tied to monsoon patterns, crop cycles, and farmer income levels. Poor rainfall or weak rural demand can affect product sales.

Competitive Pressure

The agrochemical industry is highly competitive with both domestic players and global giants. Price competition often squeezes margins for smaller companies.

Key Strengths

Despite the concerns, the company does have certain strengths.

- Diversified product portfolio across insecticides, herbicides, fungicides, and growth regulators

- Integrated business model with both technicals and formulations

- Established manufacturing presence in India

- Focus on research and product registrations

These strengths indicate that the company has built a functional agrochemical platform.

However, strong fundamentals must translate into stable profitability to justify a public listing valuation.

Key Concerns

Several issues make the IPO less attractive.

First, profitability has declined sharply over the last three years.

Second, margins have almost halved, indicating operational pressure.

Third, revenue growth remains inconsistent despite operating in a growing sector.

Fourth, the agrochemical industry itself is cyclical and heavily regulated.

Finally, the IPO valuation does not offer enough comfort given the current earnings profile.

Should Investors Subscribe?

IPO investing requires a balance between growth potential and valuation comfort.

In the case of GSP Crop Science, the numbers suggest that investors should adopt a cautious approach.

While the company operates in a promising sector, declining profitability and margin pressure raise concerns about earnings sustainability.

For long-term investors, it may be wiser to wait and observe the company’s performance after listing before considering an investment.

How Investors Can Approach IPO Opportunities

For retail investors, IPO excitement often leads to quick decisions. A better approach is to evaluate three key aspects:

- Financial stability

- Industry outlook

- Valuation compared to peers

Using research tools and expert insights can make a big difference in identifying quality opportunities.

Platforms like Swastika Investmart help investors analyze IPOs through research reports, market insights, and easy-to-use trading platforms.

Frequently Asked Questions

Is GSP Crop Science a good IPO to apply for?

Based on current financials and valuation, the IPO appears less attractive compared to peers. Investors may consider staying cautious.

What is the price band of the GSP Crop Science IPO?

The price band is ₹304 to ₹320 per share with a lot size of 46 shares.

When will GSP Crop Science IPO list?

The tentative listing date is March 24, 2026 on BSE and NSE.

What sector does the company operate in?

GSP Crop Science operates in the agrochemical industry producing crop protection products such as insecticides, herbicides, and fungicides.

Why are analysts cautious about this IPO?

Key concerns include declining profit margins, inconsistent revenue growth, and valuation risks compared with listed peers.

Conclusion

IPO markets often create opportunities for wealth creation, but careful analysis is essential before investing.

The GSP Crop Science IPO highlights why numbers matter more than hype. Despite operating in a promising agrochemical sector, the company’s declining profitability and margin pressures raise questions about its near-term growth trajectory.

For investors, patience can often be the best strategy.

If you are looking for expert IPO analysis, powerful trading tools, and reliable customer support, Swastika Investmart provides a technology-driven investing platform backed by strong research and SEBI-registered expertise.

How to Use Basic Exemption Limit to Save LTCG Tax

How to Use Basic Exemption Limit to Save LTCG Tax

Key Highlights

• The basic exemption limit can be used to reduce or eliminate long term capital gains tax for certain investors.

• If your total income is below the exemption threshold, LTCG can be adjusted against the remaining limit.

• This strategy is useful for retirees, students, and individuals with low taxable income.

• Proper planning before the financial year ends can help investors legally reduce their tax burden.

• Understanding Indian tax rules and capital gains provisions helps investors maximize after tax returns.

How to Use Basic Exemption Limit to Save LTCG Tax

Many investors focus heavily on market returns but overlook an equally important aspect of wealth creation: tax planning.

In India, long term capital gains tax on equities applies when profits exceed ₹1 lakh in a financial year. However, there is a lesser known provision that can help investors reduce or even eliminate their tax liability in certain situations.

This provision involves using the basic exemption limit available under the Income Tax Act.

For beginners and even experienced investors, understanding how to use the basic exemption limit can significantly improve after tax returns. The strategy is completely legal and widely used by tax aware investors.

Let us explore how it works.

Understanding the Basic Exemption Limit in India

Every individual taxpayer in India is entitled to a basic exemption limit. This is the portion of income that is not subject to income tax.

Under the current tax rules, the basic exemption limit generally applies as follows for individuals below 60 years of age.

₹2.5 lakh under the old tax regime.

If a person's total taxable income is below this limit, they do not need to pay income tax.

What many investors do not realize is that long term capital gains from equity investments can also be adjusted against the unused portion of this limit.

This rule becomes particularly useful for individuals with lower taxable income.

How LTCG Tax Works on Equity Investments

To understand the benefit of the exemption limit, it is important to first understand how long term capital gains are taxed.

For listed shares and equity mutual funds:

If the investment is held for more than one year, the profit is classified as long term capital gain.

Currently, long term capital gains exceeding ₹1 lakh in a financial year are taxed at 10 percent.

However, if the investor's total taxable income is below the basic exemption limit, a portion of the LTCG can be adjusted against that limit before applying tax.

This can significantly reduce the taxable amount.

A Simple Example

Consider the case of Riya, a young investor who recently started investing in the stock market.

Her annual salary income is ₹2 lakh. She also sold equity shares during the year and earned a long term capital gain of ₹1.2 lakh.

Here is how the tax calculation works.

The basic exemption limit is ₹2.5 lakh.

Riya's salary income is ₹2 lakh, leaving ₹50,000 of unused exemption.

This remaining ₹50,000 can be adjusted against her long term capital gain.

After adjustment, her taxable LTCG becomes ₹70,000.

Since the tax rule allows the first ₹1 lakh of LTCG to be exempt, Riya ends up paying zero tax on her gains.

This example highlights how proper planning can significantly reduce tax liability.

Who Can Benefit the Most from This Strategy

Using the basic exemption limit to save LTCG tax works best for certain categories of investors.

Retired Individuals

Many retirees rely on investments rather than active income. Their taxable income may fall below the basic exemption limit, allowing them to use this strategy effectively.

Students and Young Investors

Young investors who earn modest income from internships or part time work often fall below the tax threshold.

They can use the exemption limit to reduce taxes on long term gains.

Homemakers with Investments

In many families, investments are held in the name of multiple members. If one member has little or no taxable income, capital gains can sometimes be realized in their account to utilize the exemption limit.

Important Tax Rules Investors Should Know

While this strategy can reduce taxes, investors should understand the relevant tax provisions.

First, the exemption adjustment applies only if the individual's total income excluding capital gains is below the basic exemption limit.

Second, this rule is primarily applicable under the old tax regime. Taxpayers choosing the new tax regime should review the latest provisions carefully.

Third, proper documentation of transactions is essential. Investors must maintain records of purchase price, sale price, and holding period.

Regulatory bodies such as the Securities and Exchange Board of India emphasize transparency in market transactions, and accurate reporting of capital gains is important while filing income tax returns.

Impact on Investment Planning

Tax efficient strategies like this can influence how investors structure their portfolios.

For example, investors may plan the timing of stock sales to ensure gains fall within favorable tax limits.

Similarly, families may distribute investments across different members to make optimal use of exemption limits.

However, tax planning should always complement long term investment goals rather than drive them entirely.

Market fundamentals, company performance, and portfolio diversification should remain the primary focus.

Why Research and Technology Matter

Managing investments while keeping track of taxes, holding periods, and capital gains can become complex over time.

Modern investment platforms simplify this process through portfolio analytics and real time tracking.

Brokerage platforms such as Swastika Investmart, a SEBI registered brokerage firm, provide investors with advanced trading tools, research insights, and dedicated customer support.

Technology driven investing solutions help investors monitor portfolio performance while staying informed about regulatory and tax related developments.

Equally important is investor education. Understanding tax rules, market behavior, and risk management helps individuals make smarter financial decisions.

Common Mistakes Investors Should Avoid

Many investors unintentionally miss out on tax saving opportunities.

Some common mistakes include selling stocks without reviewing tax implications, ignoring exemption limits, and failing to plan transactions before the financial year ends.

Another frequent mistake is focusing entirely on taxes while ignoring the overall investment strategy.

A balanced approach that combines tax efficiency with long term wealth creation usually produces the best outcomes.

Frequently Asked Questions

What is the basic exemption limit in India?

The basic exemption limit is the portion of income that is not subject to income tax. For individuals under the old tax regime, it is generally ₹2.5 lakh for individuals below 60 years.

Can LTCG be adjusted against the basic exemption limit?

Yes. If a taxpayer's income excluding capital gains is below the basic exemption limit, the remaining portion can be adjusted against long term capital gains.

What is the current LTCG tax rate on equities?

Long term capital gains exceeding ₹1 lakh in a financial year are taxed at 10 percent without indexation.

Who benefits most from this tax saving strategy?

Retirees, students, homemakers, and individuals with low taxable income can benefit the most from using the basic exemption limit.

Is this strategy legal under Indian tax rules?

Yes. This method is fully compliant with the Income Tax Act when used correctly and reported properly in tax filings.

Conclusion

Tax planning plays an important role in maximizing investment returns. Understanding how to use the basic exemption limit to save LTCG tax can help investors reduce unnecessary tax payments while staying compliant with regulations.

For individuals with lower taxable income, this strategy can significantly improve after tax returns from equity investments.

However, tax planning should always be combined with disciplined investing, proper diversification, and long term financial goals.

If you want access to reliable research, powerful trading platforms, and investor education resources, you can start your investment journey with Swastika Investmart.

Tax-Efficient Investing: A Beginner's Guide

Tax Efficient Investing: A Beginner's Guide

Quick Summary

• Tax efficient investing helps investors keep more of their returns by reducing unnecessary tax liabilities.

• Understanding capital gains tax, holding periods, and tax saving instruments is essential for long term wealth creation.

• Investments like ELSS mutual funds, tax harvesting strategies, and long term holding can improve after tax returns.

• Regulatory rules from SEBI and tax provisions under the Income Tax Act influence investment decisions in India.

• Smart investors combine tax planning with disciplined investing and reliable research.

Tax Efficient Investing: A Beginner's Guide

Most investors focus on one thing when building wealth: returns. But there is another factor that quietly eats into profits if ignored. Taxes.

Imagine two investors who earn the same market return. One plans investments in a tax efficient way, while the other does not. Over time, the difference in their wealth can be significant simply because one investor kept more of the gains.

Tax efficient investing is not about avoiding taxes. Instead, it is about structuring investments so that legally applicable taxes are minimized while staying fully compliant with regulations.

For beginners in India, understanding this concept early can make a meaningful difference in long term wealth creation.

What Is Tax Efficient Investing?

Tax efficient investing refers to strategies that help investors reduce the tax impact on their investment returns.

Every investment generates income in some form. It could be capital gains from shares, dividends from stocks, or interest from bonds and fixed income products.

These earnings are subject to taxation under the Income Tax Act in India.

By selecting the right investment vehicles and holding periods, investors can improve their after tax returns.

A simple example illustrates this concept.

If an investor sells a stock within a year of buying it, the gain is treated as short term capital gain and taxed at a higher rate. But if the same stock is held for more than a year, the gain qualifies as long term capital gain and is taxed more favorably.

That small difference in holding strategy can significantly influence net returns.

Understanding Capital Gains Tax in India

One of the most important aspects of tax efficient investing is understanding how capital gains are taxed.

Short Term Capital Gains

If equity shares or equity mutual funds are sold within one year, the profit is classified as short term capital gain.

This gain is currently taxed at 15 percent, excluding surcharge and cess.

Frequent trading can therefore increase tax liability.

Long Term Capital Gains

If equity investments are held for more than one year, the profit becomes long term capital gain.

Currently, long term gains exceeding ₹1 lakh in a financial year are taxed at 10 percent without indexation.

For many investors, simply holding investments longer can significantly reduce taxes.

Tax Saving Investment Options in India

India offers several investment instruments that help investors reduce tax liability while building wealth.

Equity Linked Savings Scheme

Equity Linked Savings Schemes are among the most popular tax saving mutual funds.

They offer deductions under Section 80C of the Income Tax Act, allowing investors to claim up to ₹1.5 lakh in tax deductions annually.

ELSS funds also have the shortest lock in period among tax saving investments at three years.

Because these funds invest primarily in equities, they offer potential for long term wealth creation along with tax benefits.

Public Provident Fund

The Public Provident Fund is another widely used tax efficient investment.

Contributions qualify for deductions under Section 80C, and the interest earned is tax free. The maturity amount is also exempt from tax.

This makes it one of the few investments in India with EEE tax treatment, meaning exemption at investment, growth, and withdrawal stages.

National Pension System

The National Pension System is designed to support retirement planning while offering tax benefits.

Investors can claim deductions under Section 80C and an additional deduction under Section 80CCD(1B), which allows an extra ₹50,000 tax benefit.

For long term retirement investors, this combination can be quite powerful.

Tax Loss Harvesting: A Smart Strategy

Tax loss harvesting is a strategy where investors sell loss making investments to offset gains from profitable ones.

For example, suppose an investor earns ₹1.5 lakh in capital gains from stocks during the year but also holds another stock that is currently showing a loss of ₹50,000.

By selling the loss making stock before the financial year ends, the investor can offset part of the gain and reduce the taxable amount.

This strategy is commonly used by professional investors and portfolio managers to improve after tax performance.

How Tax Planning Influences the Indian Stock Market

Tax policies can influence investor behavior and market participation.

For instance, the introduction of long term capital gains tax in 2018 affected trading strategies for many equity investors.

Similarly, tax incentives for retirement products encourage long term savings in financial markets.

Regulators such as the Securities and Exchange Board of India focus on improving transparency and protecting investors while ensuring that markets remain efficient.

For investors, understanding these rules helps align investment strategies with regulatory frameworks.

The Role of Research and Technology in Tax Efficient Investing

Planning taxes effectively requires careful monitoring of portfolios, holding periods, and market opportunities.

Modern investment platforms simplify this process by providing portfolio analytics, tax insights, and research based recommendations.

Brokerage platforms such as Swastika Investmart provide investors with tools that help track investments, analyze market trends, and access professional research.

Being a SEBI registered brokerage, Swastika Investmart focuses on technology driven investing combined with strong customer support and investor education initiatives.

These resources help investors make informed decisions rather than reacting to market noise.

Common Mistakes Investors Should Avoid

Many beginners unintentionally increase their tax liability by ignoring simple strategies.

Some common mistakes include:

Frequent trading without considering tax impact.

Ignoring the benefits of long term holding.

Not utilizing deductions available under Section 80C.

Selling investments without planning capital gains offsets.

Avoiding these mistakes can significantly improve overall portfolio returns.

Frequently Asked Questions

What is tax efficient investing?

Tax efficient investing involves structuring investments to minimize tax liability while remaining compliant with tax regulations.

How are capital gains taxed on equities in India?

Short term capital gains on equities held for less than one year are taxed at 15 percent. Long term gains above ₹1 lakh are taxed at 10 percent.

What are the best tax saving investments in India?

Popular tax saving investments include ELSS mutual funds, Public Provident Fund, and the National Pension System.

What is tax loss harvesting?

Tax loss harvesting is a strategy where investors sell loss making investments to offset capital gains and reduce overall tax liability.

Why is tax planning important for investors?

Tax planning helps investors maximize after tax returns and avoid unnecessary tax payments.

Conclusion

Building wealth is not just about earning higher returns. It is also about keeping more of what you earn.

Tax efficient investing helps investors improve their after tax performance through smart strategies such as long term holding, tax saving investments, and capital gains planning.

In India’s evolving financial markets, understanding tax rules and investment structures can make a meaningful difference over time.

If you want access to research backed insights, advanced trading tools, and investor education resources, you can start your investment journey with Swastika Investmart.

Popular Articles

For Stress to success:

Trust Our Expert Picks

for Your Investments!

- Real Time Trading Power

- Trade Anywhere, Anytime

- 24/7 Customer Support

- Low Commissions and Fees

- Diverse Investment Options

Drop Your Number For personalized Support!

START YOUR INVESTMENT JOURNEY

Get personalized advice from our experts

- Dedicated RM Support

- Smooth and Fast Trading App

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)