.png)

In today's fast-paced financial markets, traders rely on algo trading to gain a competitive edge. But why do traders trust so much? The answer lies in its accuracy, speed, and data-driven approach. Let's explore the key reasons why professional and retail traders prefer automated trading systems over manual trading.

Markets move in milliseconds, and human traders can't react as fast as computers. Algo trading software executes trades in microseconds, ensuring traders never miss profitable opportunities. Whether it's high-frequency trading (HFT) or scalping strategies, automation gives traders a distinct advantage.

One of the biggest reasons traders lose money is due to fear and greed. Algorithmic trading bots remove emotions from the equation, following predefined trading strategies without hesitation. This results in disciplined and consistent execution, reducing impulsive decisions.

Traders trust algo trading systems because they can test strategies on historical stock market data before deploying them live. Backtesting in algo trading helps identify profitable patterns, refine entry/exit points, and optimize risk management.

Manual trading is prone to human errors, such as incorrect order placement or mistimed entries. Automated trading systems ensure high accuracy in trade execution, reducing costly mistakes. Precision matters, especially in options trading, forex trading, and intraday trading.

Institutional investors, hedge funds, and even retail traders trust algorithmic trading software because it can process massive trade volumes seamlessly. Unlike manual traders, who might struggle with multiple trades, algo trading bots can manage thousands of orders at once.

Another reason traders trust automated trading platforms is their ability to be customized. Traders can code their trading strategies using Python for algo trading, adjust risk parameters, and scale their operations based on market conditions.

In India, SEBI regulates algorithmic trading, ensuring fair practices. Many stock brokers offer algo trading APIs, allowing traders to build their custom trading algorithms while staying compliant with regulations.

Unlike human traders, who need rest, algo trading systems can monitor global markets 24/7. This is especially useful in cryptocurrency trading, where markets never close.

Though setting up algorithmic trading software requires an initial investment, it eventually reduces transaction costs by executing orders at optimal prices. Low-latency trading algorithms ensure minimal slippage and better returns.

Traders trust algo trading because it offers speed, precision, automation, and efficiency—all crucial for success in today’s markets. Whether you're a retail trader, institutional investor, or day trader, embracing automated trading strategies can significantly enhance your trading performance. If you haven’t explored algorithmic trading yet, now is the perfect time to start!

.png)

Algo trading in India has been a topic of intense discussion among traders and investors. Recently, there have been rumors about the SEBI ban on algo trading, causing confusion and concern. But is SEBI banning algo trading completely? Let’s dive into the details and clear up the misconceptions.

SEBI has introduced a comprehensive regulatory framework for algorithmic trading (algo trading) in India, allowing retail investors to participate, but with enhanced oversight and stricter rules for brokers and algo trading providers. The framework includes unique identifiers for orders and registration requirements to ensure transparency and fair market practices.

SEBI has now opened the doors for retail investors in algo trading, a space previously dominated by institutional investors. However, retail participants must adhere to SEBI’s compliance requirements and execute trades through registered stockbrokers offering algo trading.

To enhance transparency, SEBI has mandated unique identification numbers for all algo trade orders. This helps track the origin of each trade and prevents market manipulation through automated strategies.

Stock brokers offering algo trading services must now register and get approval for their algorithmic trading strategies. Additionally, brokers must ensure that their clients are aware of the risks associated with high-frequency trading (HFT).

Third-party algo trading platforms in India must now comply with SEBI’s strict regulations. Platforms providing algorithmic trading software need to register with the regulator and ensure their strategies are pre-approved before execution.

SEBI has raised concerns about unregulated algo trading due to the following reasons:

Market Volatility – Unchecked algo trading can trigger large fluctuations in stock prices.

Unfair Advantage – Traders with access to sophisticated algo trading software can gain an unfair edge over manual traders.

Flash Crashes – High-frequency trading (HFT) has been linked to sudden market crashes due to automated sell-offs.

If you are using algo trading software in India, here’s how these regulations might impact you:

If you are engaged in algo trading in NSE and BSE, here are some steps you should take:

While SEBI is not imposing a complete ban on algo trading in India, it is making efforts to regulate automated trading and ensure fair market participation. Traders should be aware of the new guidelines and adapt accordingly to continue using algorithmic trading in India without any legal issues.

.webp)

.png)

Delisting occurs when a company's shares are removed from a stock exchange and are no longer traded publicly. This can be a significant event for investors and can happen for various reasons, such as regulatory issues, financial troubles, or strategic decisions by the company.

·Delisting refers to the removal of a company's shares from a stock exchange. Once delisted, the shares are no longer available for trading on that exchange. Delisting can be categorized into two types:

· Voluntary Delisting: The Company chooses to delist its shares, often to go private or restructure. For example, a company might opt to delist to focus on its core operations or restructure its business model.

·Involuntary Delisting: The Company is removed from the exchange due to failure to meet listing requirements, such as financial standards or regulatory compliance. This can happen if a company consistently fails to meet the exchange's criteria for listing.

·Financial Troubles: Companies facing severe financial difficulties may be delisted if they cannot meet exchange requirements. For instance, if a company consistently reports losses and fails to turn around its financial situation, it may face delisting.

·Regulatory Issues: Non-compliance with exchange rules or regulations can lead to involuntary delisting. If a company does not adhere to regulatory requirements, it risks being removed from the exchange.

·Strategic Decisions: Companies may choose to delist to restructure or go private for strategic reasons. This might involve a strategic overhaul or a shift in focus away from public markets.

·Mergers and Acquisitions: A company may be delisted following a merger or acquisition if it is absorbed into another entity. For example, if Company A acquires Company B, Company B’s shares might be delisted as they are absorbed into Company A.

·The impact of delisting on shareholders can vary based on whether the delisting is voluntary or involuntary:

·Liquidity: Shareholders may find it challenging to sell their shares as they are no longer traded on the exchange. For example, if a stock like Jet Airways is delisted, finding buyers for its shares can become difficult.

·Value of Shares: The value of delisted shares may drop, especially if the delisting is due to financial issues. This can result in significant losses for shareholders.

·Alternative Trading Venues: After delisting, shares may trade on over-the-counter (OTC) markets, which often have lower liquidity and might not reflect the true value of the shares.

·Compensation: In voluntary delisting, companies may offer compensation or buyback options for their shares. Shareholders might receive a buyout offer, providing them with an option to sell their shares at a predetermined price.

·Investment Strategy: Shareholders need to adjust their investment strategy and may consider seeking legal or financial advice to navigate the changes and mitigate losses.

Let us understand this with an example Suppose a company like Sahara India is delisted due to financial troubles. Shareholders might experience a sharp decline in share value and face difficulties finding buyers. If Sahara India had planned a voluntary delisting to go private, shareholders might receive a buyout offer, providing them with an option to sell their shares at a predetermined price.

Did you know that Suzlon Energy, a major player in the renewable energy sector, was delisted from the Bombay Stock Exchange (BSE) in 2021 due to non-compliance with financial requirements? This delisting was a significant event, impacting many investors and highlighting the importance of financial health in maintaining a public listing.

Delisting of shares can have significant consequences for shareholders, ranging from reduced liquidity to potential loss in value. It's essential for investors to stay informed about the reasons behind the delisting and how it may affect their investments.

.webp)

.png)

Welcome! Today, we’ll explore Bond ETFs—an investment option that combines the stability of bonds with the flexibility of exchange-traded funds (ETFs). Bond ETFs are increasingly popular among investors looking for a blend of steady income and trading flexibility. Let’s break down what Bond ETFs are, how they work, and why they might be a good fit for your investment strategy.

Bond ETFs are exchange-traded funds that invest primarily in bonds. These funds are traded on stock exchanges just like individual stocks and hold a diversified portfolio of bonds. Bond ETFs offer exposure to fixed income securities while providing the benefits of trading flexibility and diversification.

Bond ETFs offer a convenient and cost-effective way to invest in bonds while benefiting from the liquidity and flexibility of the stock market. They provide diversification, transparency, and regular income, making them an appealing choice for many investors. However, it’s essential to be aware of the risks, such as interest rate and credit risk, and consider how they fit into your overall investment strategy.

Learn More about stock exchanges and its terminologies with Swastika

.webp)

.png)

Today, we’re diving into the world of value stocks—a fascinating area of investing that can offer great opportunities. But what exactly are value stocks? Simply put, value stocks are shares of companies that appear to be undervalued relative to their true worth. This means they might be trading at a lower price compared to their intrinsic value, presenting a potential investment opportunity.

In summary, value stocks are shares of companies that are potentially undervalued compared to their true worth. They often have low P/E ratios, high dividend yields, and strong financial fundamentals. While investing in value stocks can offer benefits such as capital appreciation and income generation, it also comes with risks like market timing and company-specific issues. Always conduct thorough research before investing and consider consulting with a financial advisor to ensure that your investment choices align with your financial goals.

Understand key market terms to make smarter investment decisions. Start Now!

.webp)

.png)

When you're looking at a company's finances, one important measure to check is the quick ratio. It helps you understand how well a company can pay its short-term bills with the money it can quickly turn into cash. Let's break down what the quick ratio is, why it's important, and how you calculate it.

The quick ratio, also called the acid-test ratio, measures a company's ability to cover its short-term liabilities with its most liquid assets. Liquid assets are those that can be quickly converted into cash, like cash itself, accounts receivable, and marketable securities.

The quick ratio is important for several reasons:

The quick ratio is calculated with this formula:

Quick Ratio=Current Assets−InventoryCurrent Liabilities\text{Quick Ratio} = \frac{\text{Current Assets} - \text{Inventory}}{\text{Current Liabilities}}Quick Ratio=Current LiabilitiesCurrent Assets−Inventory

Here’s what each term means:

Imagine a company has:

The quick ratio would be:

Quick Ratio=100,000−30,00050,000=70,00050,000=1.4\text{Quick Ratio} = \frac{100,000 - 30,000}{50,000} = \frac{70,000}{50,000} = 1.4Quick Ratio=50,000100,000−30,000=50,00070,000=1.4

This means the company has $1.40 in liquid assets for every $1 of short-term liabilities.

Here’s how to interpret the quick ratio:

While the quick ratio is helpful, it has some limits:

The quick ratio is a handy tool for checking a company’s short-term financial health. By understanding and calculating the quick ratio, you can see if a company can meet its immediate obligations. However, remember to consider the quick ratio alongside other financial measures for a complete picture.

The stock market doesn't have to be intimidating—Start Learning Today!

.webp)

.png)

Value investing involves picking stocks that appear to be trading for less than their intrinsic or book value. Value investors actively search for stocks they believe the market is underestimating. They hold the conviction that the market often overreacts to good and bad news, resulting in stock price movements that do not align with a company's long-term fundamentals. This overreaction creates opportunities to purchase stocks at discounted prices.

The main objective of value investing is to purchase stocks when they are on sale and sell them when they reach or exceed their intrinsic value. Value investors look for companies with long-term potential that are experiencing temporary price downturns. They follow a few key steps:

Value investors use the margin of safety to reduce risk. This means purchasing stocks at a price significantly lower than their intrinsic value. Even if their assessment is slightly off, the lower purchase price minimizes potential losses..

Value investing can be a great way to build wealth over the long term. However, it requires patience, discipline, and a willingness to do your research. Consider your investment goals and risk tolerance before deciding if value investing is the right approach for you.

| Value Investing | Growth Investing |

|---|---|

| Investing in companies that are considered undervalued or mispriced based on their current market price and financial performance. | Investing in companies with high growth potential, regardless of the current stock price. This approach focuses more on future potential than current value. |

| Low-level of risk | High-level of risk |

| Traded at discounted price | Traded at a high price |

Value investing is an investment strategy where investors seek to buy shares, bonds, real estate, or other assets for less than their intrinsic value. It requires uncovering the true worth of assets and developing the patience to purchase them at prices lower than their intrinsic value. This approach offers a way to profit from market inefficiencies and overreactions, providing substantial returns over the long term.

The stock market doesn't have to be intimidating—Start Learning Today!

.webp)

.png)

Options trading is a popular strategy in finance for managing risks and making potential profits. While many people know about options traded on exchanges, there's another flexible option: Over-the-Counter (OTC) options. Let’s break down what OTC options are, the different types, and their benefits.

OTC options are agreements made directly between two parties rather than on a public exchange. These deals are customized to fit the needs of both parties. Unlike exchange-traded options, OTC options come with a risk that one party might not fulfill their part of the deal (known as counterparty risk).

OTC options can be simple or quite complex. Here are the main types:

OTC options have several advantages:

Over-the-Counter options are a versatile tool for managing financial strategies. Despite the risk of one party not fulfilling the deal, the benefits of customization, privacy, and cost savings make OTC options valuable. Whether for hedging, speculating, or complex strategies, OTC options offer flexibility and innovation in the financial world.

Learn More about stock market trading with Swastika Investmart.

.webp)

.png)

When you invest your money, it’s important to have proof of where it’s going and what it’s earning. A Fixed Deposit Receipt (FDR) is exactly that proof for a fixed deposit. Let’s break down what a Fixed Deposit Receipt is, why it matters, and what you need to know about it.

A fixed deposit is a type of savings account where you deposit a lump sum of money for a specific period at a fixed interest rate. At the end of this period, you get back your initial amount plus the interest earned.

A Fixed Deposit Receipt is a document given to you by the bank or financial institution when you open a fixed deposit account. This receipt confirms that you have made the deposit and outlines the details of your investment.

A Fixed Deposit Receipt usually includes the following details:

A Fixed Deposit Receipt is important for several reasons:

Since the Fixed Deposit Receipt is an important document, it’s crucial to keep it safe. Here are some tips:

A Fixed Deposit Receipt is an essential document that provides proof and details of your fixed deposit investment. Understanding its importance and keeping it safe ensures that you can manage your investments effectively. Whether you’re an experienced investor or new to fixed deposits, taking care of your Fixed Deposit Receipt is crucial for your financial security and peace of mind.

Learn the language of investing and achieve your financial goals with Swastika Investmart!

.webp)

.png)

When it comes to investing in stocks, there are two main ways people analyze which stocks to buy or sell: fundamental analysis and technical analysis. These methods help investors make decisions based on different aspects of a company's performance and market behavior. Here’s a simple breakdown of how they work and what sets them apart.

Fundamental analysis is like looking under the hood of a car to see how it works. It involves:

If you hear a company has been making a lot of profit and has a strong business plan, a fundamental analyst might think it’s a good investment for the future.

Technical analysis is more about looking at how a stock has performed in the past to predict its future. It involves:

A technical analyst might look at a chart showing a stock’s price over the last few months to see if it’s going up or down, then decide to buy or sell based on that pattern.

Both fundamental and technical analysis are valuable tools for investors, offering different perspectives on how to choose stocks. Whether you’re looking to grow your money over time or make quick gains, understanding these methods can help you make smarter investment decisions that fit your goals and risk tolerance. Integrating both approaches or focusing on one that matches your investing style can improve your chances of success in the dynamic world of stock markets.

Learn the language of investing and achieve your financial goals with Swastika Investmart!

.webp)

.png)

A Demat or Dematerialized Account is like a digital locker for your stocks and investments. You don't need to worry about keeping track of physical certificates anymore. Instead, everything is stored electronically with a Depository Participant (DP), showing that you own those investments. This means you can trade or transfer them smoothly whenever you want, without dealing with paper documents.

A Demat Account provides strong security measures, reduces paperwork, makes transactions smoother, and improves how you keep track of your investments. But that's not all! By opening a Demat Account, you open the door to many opportunities. You can trade not just in stocks but also in other areas like derivatives, commodities, and currency. Plus, you get access to extra services like voting online for company decisions, bidding for new stocks, and enjoying perks from the companies you invest in. Overall, it makes your investment journey easier and more rewarding.

Opening an online trading account is the first step towards becoming a successful investor. Before we begin, decide whether you want to open an account with Swastika through their website or with Justrade2.0 via their mobile app. Both options offer user-friendly interfaces and convenient features to make the account opening process seamless.

Via Website (Swastika):

Via Mobile App (Justrade2.0):

That's it! Following these steps will help you open an account with Swastika via their website or with Justrade2.0 via their mobile app

To open a demat & share trading account you need the following documents

For Indian resident individuals

Futures and Options

For Equity and Currency Derivatives you would require an income proof along with the above-mentioned documents. Income proof can be any one of the following -

A trading account is a type of investment account that allows you to buy and sell financial securities, such as stocks, bonds, options, and commodities, through a brokerage firm or financial institution. It acts as a gateway to the stock market, enabling you to execute trades and participate in various investment opportunities.

When you open a trading account, you are provided with a unique account number and login credentials that grant you access to the trading platform offered by your broker. Through this platform, you can place buy and sell orders, monitor your portfolio, view market data and charts, and manage your investments.

Trading accounts come in different types, such as cash accounts and margin accounts. In a cash account, you can only trade with the funds you have deposited, while a margin account allows you to borrow money from the broker to increase your buying power, subject to certain conditions and margin requirements.

Overall, a trading account is essential for individuals looking to actively participate in the financial markets and build their investment portfolios.

A Depository Participant is like a middleman between you and the stock market. They can be a bank or a brokerage firm registered with either CDSL or NSDL. You can find a list of these participants online and pick the ones with the best services.

There are two main types of brokerage firms: discount and service. Discount brokers mainly focus on trading stocks and derivatives according to your instructions. Service brokers offer a wider range of services, like advice on investments, mutual funds, insurance, and IPOs. Before you open an online demat account, decide which type of brokerage services you need.

Can I hold different types of securities in a Demat account?

Yes, you can hold various types of securities such as equities, bonds, mutual funds, ETFs, government securities, and derivatives in a Demat account.

Demat accounts automate the dematerialisation of securities linked to the trading account. If you have physical securities from previous trades, they can be dematerialised by paying a fee. Additionally, Demat accounts offer rematerialisation services, allowing you to convert dematerialised securities back into their physical form when needed.

Opening a Demat account online can be safe if you choose a reputable brokerage firm, verify security measures, use secure devices and networks, keep login credentials secure, monitor account activity, beware of phishing attempts, and keep software updated. By following these precautions, you can securely manage your investments and enjoy the convenience of online trading without compromising your financial security.

A Demat account offers a secure, paperless way to manage investments like stocks, bonds, and mutual funds. It simplifies trading, reduces paperwork, and provides access to a variety of investment opportunities. By opening a Demat account with a reliable broker, you can trade efficiently and benefit from added services like online voting and bidding for new stocks. With proper security measures, online trading becomes safe and convenient, making investing more accessible and rewarding.

Stay updated with Swastika Investmart for more financial insights. JOIN NOW

.png)

Stock trading can be very profitable, especially if you stick with it for a long time. To be successful, it's important to understand things like a company's financial health and its real value.

Trading has been around for a long time, starting with the barter system where people traded goods directly with each other. This old form of trading laid the groundwork for the modern stock market.

The stock market is a place where people buy and sell shares of companies. These shares represent part ownership in the business. The first modern stock exchange started in Amsterdam in 1602, where people traded shares of the Dutch East India Company.

Derivatives, which are contracts based on the value of an asset, were first traded in 1607 by a single company. Dividends, or profits shared with stockholders, were given out a few years later. Amsterdam was also the birthplace of futures and options trading.

Today, more and more people are getting interested in the stock market, even those who don’t have much experience. Many see trading as a good way to grow their wealth.

Staying consistently profitable in trading is the goal of every trader, but the journey isn’t always smooth. However, by following some proven strategies, you can increase your chances of staying in the green. Here are ten tried and tested trading strategies to help you stay in profit, explained in simple language.

The foundation of successful trading is having a clear goal and a solid plan. Before you even make your first trade, know what you want to achieve.

A stop-loss order is a tool that automatically sells your stock if it drops to a certain price, preventing further losses.

Diversification means spreading your investments across different assets or sectors to reduce risk.

Trend trading is a strategy where you make decisions based on the direction of the market.

Risk management involves controlling the amount of money you expose to potential loss on any given trade.

Emotions like fear and greed can cloud your judgment and lead to poor trading decisions.

Markets are constantly changing, so it’s important to review your trading strategy regularly.

Support and resistance levels are key concepts in technical analysis that can help you make better trading decisions.

Technical indicators like moving averages, Relative Strength Index (RSI), and MACD can provide insights into market trends and potential entry and exit points.

The financial markets are influenced by various factors, including economic data, geopolitical events, and market sentiment. Staying informed helps you anticipate potential changes.

Trading for profit requires discipline, knowledge, and the right strategies. By setting clear goals, managing risk, following trends, and staying updated, you can increase your chances of consistent profitability. Remember, no strategy guarantees success, but these ten tried and tested methods can significantly enhance your trading outcomes.

.png)

Price Patterns are shapes or formations on charts that can be categorized and used to predict future price movements.

These patterns have been seen repeatedly across different charts and times, proving their reliability.

Classification of Patterns

Reversal patterns are important signals in trading that suggest a current trend (whether it's going up or down) might soon change direction. They usually appear after a long period of a particular trend. These patterns help traders predict when a trend might be ending and a new one might start.

Common examples of reversal patterns include:

Continuation patterns are signals in trading that suggest a brief pause in the current trend, but the trend is likely to continue in the same direction after the pause. In other words, the trend takes a short break and then keeps going.

Common examples of continuation patterns include:

In this blog, we will have a brief look at how these patterns look.

Double Top : A Double Top is a bearish reversal pattern that signals a potential end to an uptrend. It forms when the price creates two high points (highs) at nearly the same level, separated by a period of time.

Tip: One will find double top developing often in stocks but one must look at the prior trend and volume to rely on the formation.

Double Bottom

A Double Bottom pattern is a bullish reversal pattern signalling a potential end to a downtrend.

Triple Top

A Triple Top is a bearish reversal pattern that indicates the potential end of an uptrend. It features three distinct high points at roughly the same price level. Here’s a simplified explanation:

Tip: Pattern is complete when the both lows have been broken on heavier volume.

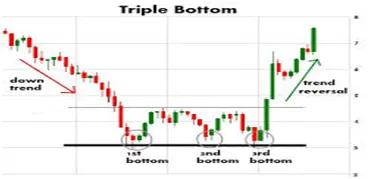

Triple Bottom

A Triple Bottom is a bullish reversal pattern that signals the potential end of a downtrend. It features three distinct low points at roughly the same price level.

Head & Shoulders

Inverse Head and Shoulders

The Inverse Head and Shoulders, signals a potential change from a downtrend to an uptrend. Here’s how it forms:

When the price breaks above the neckline, it suggests the downtrend may be ending, and the price could start rising.

Broadening Formations

Broadening Formations are patterns where the price creates an expanding triangle. Unlike regular triangles, where the trend lines come together, broadening formations have trend lines that spread out, making the shape of an expanding triangle.

In simple terms, as the price moves, the highs and lows get further apart, creating a pattern that looks like an expanding triangle.

Broadening Bottoms

A Broadening bottom looks like a megaphone and appears during a downtrend. It features:

This pattern is a bullish reversal signal, meaning that after it forms, the price trend is likely to shift from down to up.

Volume: Trading volume is often uneven but tends to rise when the price goes up and fall when the price goes down.

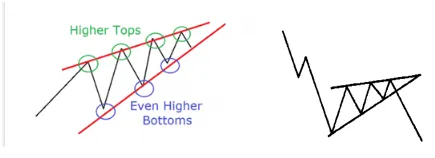

Broadening Wedges Ascending

A Broadening Wedges Ascending is a bearish reversal pattern where:

This pattern indicates that the current uptrend might be ending and a downtrend could begin

Broadening Wedges Descending

A Broadening Wedges Descending is a bullish reversal pattern where:

This pattern suggests that the downtrend might be ending and a new uptrend could start.

RISING WEDGE

A Rising Wedge is a bearish pattern that forms when prices start wide at the bottom and gradually narrow as they move higher. This pattern slopes upward and signals a potential drop in prices. Here's a simple breakdown:

Regardless of whether it's a continuation or a reversal, a rising wedge usually predicts a drop in prices.

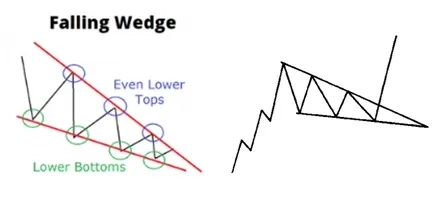

Falling Wedge Pattern

A falling wedge is a chart pattern that looks like a downward-sloping cone. It starts wide at the top and gets narrower as the price moves lower.

Overall, whether it’s a continuation or a reversal, a falling wedge generally suggests that prices are likely to rise after the pattern finishes.

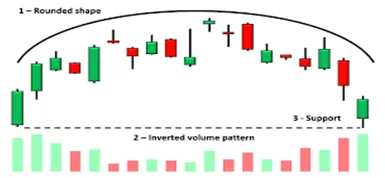

Rounding Top

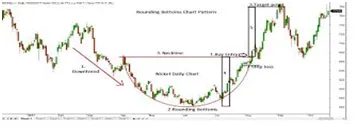

Rounding Bottom

A rounding bottom pattern is a bullish consolidation pattern where the price trend gradually curves upward over time, resembling the shape of a cup. This pattern suggests that the market is slowly gaining strength and is likely to continue rising after the consolidation period.

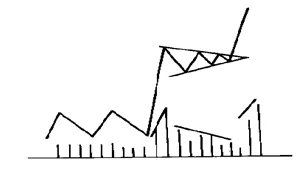

Flags and Pennants are short-term continuation patterns that show a brief pause in a strong price move before the trend continues in the same direction. These patterns appear after a sharp rise or fall in price with high trading volume.

Flags look like small rectangles that slope against the trend. This pattern looks like a small rectangle that slopes against the main trend. Volume usually decreases during the formation, then picks up again when the price breaks out of the flag.

Pennants have a triangular shape. This pattern looks like a small triangle with converging trend lines and resembles a short symmetrical triangle. Like flags, volume typically decreases during the pattern and increases when the price breaks out.

Both patterns indicate a short break before the price resumes its previous direction, whether up or down.

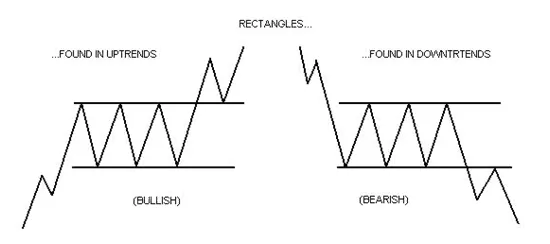

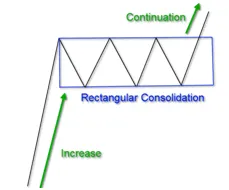

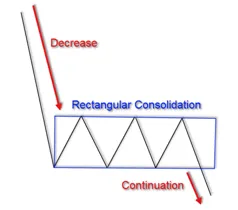

Rectangle

A Rectangle is a continuation pattern that forms when the price moves within a set range during a break in the trend. It looks like a rectangle because the price has two highs and two lows that create parallel lines at the top and bottom.

This pattern shows that the price is pausing and is likely to continue in the same direction once it breaks out of the range.

Rectangle Top

Bullish Rectangle Pattern: This is a bullish reversal pattern where the price also moves within a horizontal range, with two horizontal trend lines. When the price breaks above this range, it usually indicates an upward move.

Rectangle Bottom

Bearish Rectangle Pattern: This is a bearish reversal pattern where the price moves within a horizontal range, forming two horizontal trend lines. When the price breaks below this range, it often signals a downward move.

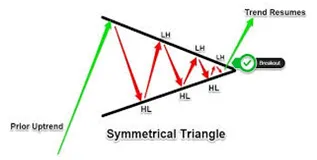

Symmetrical Triangle

A Symmetrical Triangle pattern forms when two trend lines come together and create a triangle shape.

As the triangle forms, trading volume usually decreases. The pattern indicates that the price could break out in either direction when it reaches the apex.

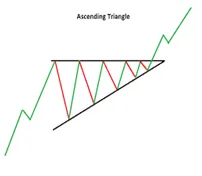

Ascending Triangle

An Ascending Triangle is a bullish pattern that generally forms during an uptrend. It features:

This pattern often signals that the price will keep rising after the triangle forms. It can also appear at the end of a downtrend as a reversal pattern, but it's usually a continuation pattern that shows the price is likely to keep going up.

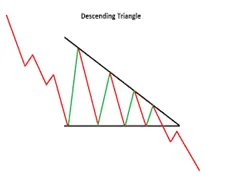

A Descending Triangle is a bearish pattern that usually forms during a downtrend. It has:

This pattern often signals that the price will continue to fall after the triangle forms. It can also appear at the end of an uptrend as a reversal pattern, but it typically indicates the price is likely to keep going down.

Price patterns on charts, whether reversal or continuation, play a vital role in predicting future price movements in the market. Reversal patterns like Double Top, Double Bottom, and Head & Shoulders signal changes in the direction of the current trend, while continuation patterns like Flags, Pennants, and Triangles indicate a brief pause before the trend resumes. Understanding these patterns helps traders make informed decisions about when to enter or exit trades, maximizing potential profits. By analyzing the shape and volume accompanying these patterns, traders can gain insights into market sentiment and anticipate price shifts.

Stay updated with Swastika and learn more about stock market and its terminologies!

.png)

The National Pension System (NPS) is a government-sponsored retirement savings scheme in India, introduced in 2004. It has gained popularity among investors seeking a low-cost, long-term savings option for their retirement. This blog post will discuss the basics of NPS, its features, tax benefits, rules, and the types of NPS accounts, along with the advantages and disadvantages of investing in it.

The National Pension System is a voluntary, defined-contribution retirement savings scheme that allows subscribers to accumulate savings for their retirement. Under this scheme, subscribers can regularly contribute to their NPS account, and the funds are invested in a mix of equity, debt, and government securities, based on their investment preferences. Upon retirement, subscribers can withdraw a portion of their savings as a lump sum, and the remaining amount is paid out as a monthly pension.

To open an NPS account, subscribers can visit the NPS Trust website and register by providing personal and bank details. They can also choose a fund manager and select their investment preferences. Subscribers are given a Permanent Retirement Account Number (PRAN) to manage their account and make contributions. Subscribers can log in to their NPS account to check their balance, view transactions, and make contributions.

The NPS has certain rules and regulations that subscribers must follow:

The National Pension System is a popular retirement savings option in India, offering a low-cost, flexible, and tax-efficient way to build a retirement fund. While there are certain disadvantages, such as compulsory annuity and market risk, the advantages of the scheme make it a good option for long-term retirement planning. As always, investors should carefully consider their investment goals and risk tolerance before investing in any financial instrument, including the National Pension System.

Learn more about financial insights with Swastika Investmart. JOIN NOW!

.webp)

.png)

Derivatives are financial instruments whose value is derived from the performance of an underlying asset, index, or rate. These instruments are essential in financial markets for purposes such as hedging risk, speculating on future price movements, and arbitraging price discrepancies. In India, the derivatives market has seen substantial growth, with the National Stock Exchange (NSE) reporting an average daily turnover of ₹52.8 trillion in FY2022-23. Derivatives can be broadly categorized into two types based on their payoff structure: linear and non-linear derivatives. Let's explore these in simple terms.

Linear derivatives have a straightforward, direct relationship with the price of the underlying asset. Their value changes proportionally with the changes in the underlying asset's price. The two main types of linear derivatives are futures and forwards.

Forward contracts are customized agreements between two parties to buy or sell an asset at a specified future date for a price agreed upon today. These contracts are traded over-the-counter (OTC), meaning they are negotiated directly between the parties involved and not on an exchange.

How They Work: Imagine you and a farmer agree that you will buy 1,000 kg of wheat at ₹25 per kg in six months. This contract is tailor-made to your needs.

Example: If the market price of wheat rises to ₹28 per kg, your forward contract has increased in value because you can buy at the lower price of ₹25.

Use Cases: Forwards are used for the same reasons as futures but offer more flexibility in terms of contract size and settlement dates.

Futures contracts are standardized agreements to buy or sell a specific quantity of an asset at a predetermined price on a specified future date. Unlike forward contracts, futures are traded on organized exchanges.

Equity futures involve buying or selling individual stocks at a future date and at a predetermined price. These contracts are used for speculation and hedging purposes. India's equity futures market is one of the largest in the world, with the NSE's Nifty 50 index futures being highly popular among traders.

Currency futures are contracts that involve the exchange rate of currency pairs such as USD/INR, EUR/INR, and GBP/INR. These contracts help manage currency risk for businesses and enable currency speculation. The USD/INR futures are among the most traded currency futures in the Indian market.

Commodity futures involve contracts for physical goods such as agricultural products (wheat, sugar), metals (gold, silver), and energy products (crude oil, natural gas). India has a robust commodity futures market, with gold and crude oil futures being particularly active.

How They Work: Suppose you agree to buy 100 shares of Reliance Industries in three months at ₹2,000 per share. Regardless of the market price at that time, you will buy them at ₹2,000 per share.

Options are contracts that provide the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before or at the contract's expiration. There are two main types of options: call options and put options.

Options are versatile financial instruments that give traders and investors the right, but not the obligation, to buy or sell an asset at a predetermined price (strike price) within a specified time frame (expiry date). They are widely used in the Indian stock market for various trading and hedging strategies. Let's explore the main types of options and positions available:

Call options give the holder the right to buy an underlying asset at a specified price (strike price) on or before the expiration date.

2. Put Options

Put options give the holder the right to sell an underlying asset at a specified price (strike price) on or before the expiration date.

Traders hold a long position when they purchase a call or put option.

2. Short Position

A trader holds a short position when they sell (write) a call or put option.

Non-linear derivatives refer to financial instruments whose value does not move in a straightforward linear manner with changes in the price of the underlying asset. Unlike linear derivatives such as forwards or futures, where the payoff is directly proportional to the price movement of the underlying asset, non-linear derivatives exhibit more complex payoffs that may include options, swaps, and more specialized structures. Here are some common types of non-linear derivatives:

Swaps are contracts in which two parties agree to exchange cash flows or other financial instruments over a specified period. The most common types of swaps are interest rate swaps, currency swaps, and commodity swaps. India's swap market, though not as large as its Western counterparts, has been growing steadily, with interest rate swaps being particularly prevalent among financial institutions.

Derivatives, including forward contracts, futures contracts, options contracts, and swap contracts, play a crucial role in modern financial markets. They provide tools for hedging risk, speculating on future price movements, and capitalizing on hedging opportunities. Understanding the mechanics, benefits, and risks associated with each type of derivative is essential for anyone looking to engage in derivative trading. In India, the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) are key players in the derivatives market, offering a wide range of derivative products. As with any financial instrument, thorough research, risk management, and a deep understanding of the underlying asset and market conditions are vital to successful trading in derivatives markets.

.png)

Within the financial sector, derivatives trading plays an important role in enabling investors to manage risk, speculate on market movements, and potentially enhance returns. While the term "derivatives" might sound complex, their underlying concepts are crucial for anyone looking to delve into financial markets. This guide aims to explain derivatives trading, explaining its basics, types, strategies, and significance in a simple and engaging manner.

Derivatives are financial contracts whose value is derived from the performance of an underlying asset, index, or interest rate. They serve as instruments for investors to either hedge against risks or speculate on future price movements. Unlike stocks or bonds, which represent ownership or debt, derivatives offer a way to bet on or protect against price fluctuations without owning the underlying asset itself.

Example: Crude Oil Futures

Scenario:

Example: Nifty 50 Call Option

Scenario:

Example: Interest Rate Swap

Scenario:

Example: Currency Forward

Scenario:

While derivatives offer opportunities for profit and risk management, they also carry inherent risks:

Derivatives trading is a powerful tool in the financial markets, providing avenues for risk management, speculation, and market efficiency. Understanding the basics of futures, options, swaps, and forwards equips investors with the knowledge to navigate these instruments effectively. Whether you're a seasoned investor or a newcomer to finance, grasping the fundamentals of derivatives trading is essential for smart decision-making in today's interconnected global economy.

In essence, derivatives are not just financial instruments but essential components of modern market dynamics, shaping how risks are managed and opportunities are seized in the ever-evolving landscape of global finance.

Unlock trading potential with swastika!

.png)

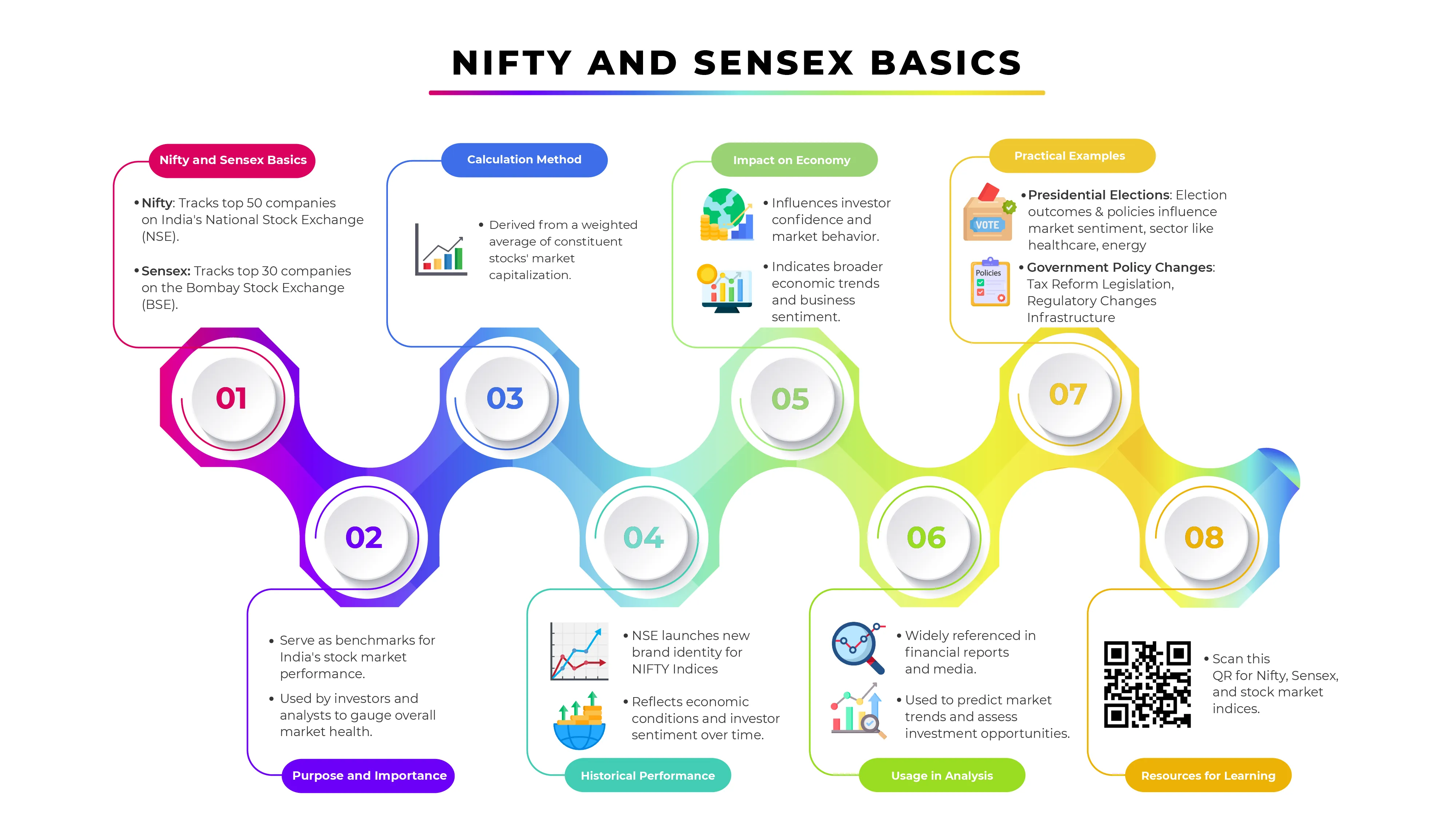

Nifty and Sensex are India's primary stock market indices, representing the performance of the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) respectively. They are crucial for investors to measure the health and trends of the stock market.

Nifty, also known as the Nifty 50, is India's leading index of the National Stock Exchange (NSE). Launched in 1996, it represents the weighted average of the 50 largest and most liquid stocks traded on the NSE, making it a crucial barometer of the Indian capital markets and a reflection of the overall market performance. The Nifty 50 includes companies across various sectors, ensuring a comprehensive view of the market.

In addition to the Nifty 50, the NSE offers several other indices to provide a broader and more detailed understanding of market dynamics:

Recent Developments

The NSE has recently introduced a new index focused on the electric vehicle (EV) sector, reflecting this industry's growing importance and potential. This index aims to capture the performance of companies involved in the manufacturing, development, and supply chain of electric vehicles, highlighting the shift towards sustainable and eco-friendly transportation solutions.

The Nifty 50 index is diversified across various sectors, with the top five sectors contributing significantly to its overall performance. As of the latest data, the sectoral weightage in the Nifty 50 is as follows:

Source - https://scripbox.com/pf/what-is-nifty/

Sensex or Sensitive Index, is India's benchmark index of the Bombay Stock Exchange (BSE). Launched in 1986, it is one of the oldest stock market indices in the country. Sensex comprises 30 well-established and financially sound companies across various sectors. These companies are selected based on their market capitalization and liquidity, representing the overall performance and health of the stock market.

Both indices use free-float market capitalization, considering only the shares available for public trading. The formula involves stock prices and the number of publicly traded shares.

Both indices cover diverse sectors. Nifty includes companies from sectors such as IT, finance, consumer goods, and energy. Sensex also represents a wide array of sectors, providing a holistic view of the market.

Market capitalization is the total market value of a company's outstanding shares. The free-float methodology calculates market cap by excluding promoter and insider holdings, focusing only on shares available for public trading.

The formula for calculating the free float market capitalization is:

Free-Float Market Capitalization = Share Price × Number of Free-Float Shares

To determine the number of free-float shares:

Free-Float Shares = Total Outstanding Shares − Restricted Shares

Restricted shares include those held by promoters, insiders, and other strategic investors that are not available for public trading.

Nifty and Sensex have shown significant growth over the years, reflecting the overall economic development of India. Historical performance data can help investors identify long-term trends and investment opportunities.

These indices are not only indicators of stock market performance but also reflect the economic conditions of the country. They are influenced by various factors, including economic policies, geopolitical events, and global market trends.

Nifty and Sensex are essential tools for anyone involved in the Indian stock market. They provide a snapshot of market trends, economic health, and sectoral performances, helping investors make informed decisions. Understanding these indices can enhance your investment strategies and lead to better financial outcomes.

.png)

Dividends are a way for companies to share their profits with people who own their stock. But to receive a dividend pay-out, timing is key. Let’s break down what dividends are and the important dates you need to know if you're investing in the Indian stock market.

A dividend is a payment made by a company to its shareholders from its profits. When a company grows and decides to go public, it allows people to buy its shares through an Initial Public Offering (IPO). Once people buy shares, they become shareholders and can receive dividends from the company’s profits. These payments are often made regularly, such as every three months or once a year.

The ex-dividend date is an important date for anyone buying stocks. It’s the deadline by which you must own the stock to get the next dividend payment. If you buy the stock on or after this date, you won't get the upcoming dividend; the previous owner will.

So in simple words, If you purchase a stock before the ex-dividend date, you're considered a shareholder of record. This means you'll be entitled to receive the next dividend pay-out.

If you buy the stock on or after the ex-dividend date, you won't be eligible for the upcoming dividend. The seller in this case will receive the pay-out.

When a stock goes ex-dividend, its price usually drops by the amount of the dividend. For example, if a company pays a ₹10 dividend and the stock price was ₹1000, it might drop to ₹990 on the ex-dividend date. This drop happens because the dividend is no longer included in the stock price.

There are three key dates to remember when it comes to dividends:

Knowing about dividends and the important dates can help you make better decisions when investing in stocks. The date is especially important because it determines whether you get the next dividend payment. By keeping track of these dates, you can manage your investments more effectively.

.png)

Dividends are a way for companies to share their profits with people who own their stock. But to receive a dividend pay-out, timing is key. Let’s break down what dividends are and the important dates you need to know if you're investing in the Indian stock market.

A dividend is a payment made by a company to its shareholders from its profits. When a company grows and decides to go public, it allows people to buy its shares through an Initial Public Offering (IPO). Once people buy shares, they become shareholders and can receive dividends from the company’s profits. These payments are often made regularly, such as every three months or once a year.

The ex-dividend date is an important date for anyone buying stocks. It’s the deadline by which you must own the stock to get the next dividend payment. If you buy the stock on or after this date, you won't get the upcoming dividend; the previous owner will.

So in simple words, If you purchase a stock before the ex-dividend date, you're considered a shareholder of record. This means you'll be entitled to receive the next dividend pay-out.

If you buy the stock on or after the ex-dividend date, you won't be eligible for the upcoming dividend. The seller in this case will receive the pay-out.

As an example, a company that is trading at 60 per share declares a 2 dividend on the announcement date. As the news becomes public, the share price may increase by 2 and hit 62.

If the stock trades at 63 one business day before the ex-dividend date. On the ex-dividend date, it's adjusted by 2 and begins trading at 61 at the start of the trading session on the ex-dividend date, because anyone buying on the ex-dividend date will not receive the dividend.

There are three key dates to remember when it comes to dividends:

Knowing about dividends and the important dates can help you make better decisions when investing in stocks. The date is especially important because it determines whether you get the next dividend payment. By keeping track of these dates, you can manage your investments more effectively.

.webp)

.png)

An order is an instruction given to a broker or brokerage firm to buy or sell a security for an investor. It's the basic way to trade in the stock market. Orders can be placed by phone, online, or through automated systems and algorithms. Once an order is placed, it goes through a process to be completed.

There are different types of orders, allowing investors to set conditions like the price at which they want the trade to happen or how long the order should stay active. These conditions can also determine whether an order is triggered or cancelled based on another order.

A market order is an instruction to buy or sell a stock at the current price available in the market. With a market order, the investor doesn't control the exact price they pay or receive—the market decides the price. In a fast-moving market, the price can change quickly, so you might end up paying more or receiving less than expected.

For example, if an investor wants to buy 100 shares of a stock, they will get those 100 shares at whatever the current asking price is at that moment. If the price is ₹500 per share, they’ll buy 100 shares for ₹500 each. However, if the price changes before the order is executed, they might pay a different amount.

A limit order is an instruction to buy or sell a stock at a specific price or better. This allows investors to avoid buying or selling at a price they don't want. If the market price doesn't match the price set in the limit order, the trade won't happen. There are two types of limit orders: a buy limit order and a sell limit order.

A buy limit order is placed by a buyer, specifying the maximum price they are willing to pay. For example, if a stock is currently priced at ₹900, and an investor sets a buy limit order for ₹850, the order will only go through if the stock price drops to ₹850 or low

A sell limit order is placed by a seller, specifying the minimum price they are willing to accept. For example, if a stock is currently priced at ₹900, and an investor sets a sell limit order for ₹950, the order will only go through if the stock price rises to ₹950 or higher.

A stop order, also known as a stop-loss order, is a trade order that helps protect an investor from losing too much money on a stock. It automatically sells the stock when its price drops to a certain level. While stop orders are commonly used to protect a long position (where the investor owns the stock), they can also be used with a short position (where the investor has sold a stock they don't own yet). In that case, the stock would be bought if its price rises above a certain level.

Example for a Long Position:

Imagine an investor owns a stock currently priced at ₹1,000. They're worried the price might drop, so they place a stop order at ₹800. If the stock price falls to ₹800, the stop order will trigger, and the stock will be sold. However, the stock might not sell exactly at ₹800—it could be sold for less if the price is dropping quickly.

Example for a Short Position:

If an investor has shorted a stock at ₹1,000 and doesn't want to lose too much if the price rises, they might set a stop order at ₹1,200. If the price goes up to ₹1,200, the stop order will trigger, and the investor will buy the stock at that price (or higher if the price is rising quickly) to cover their short position.

To avoid selling at a much lower price than expected, investors can use a stop-limit order, which sets both a stop price and a minimum price at which the order can be executed.

A stop-limit order is a trade order that combines features of both a stop order and a limit order. It involves setting two prices: the stop price and the limit price. When the stock reaches the stop price, the order becomes a limit order. This means the stock will only be sold if it can meet or exceed the limit price, giving the investor more control over the selling price.

Example:

Let's say an investor owns a stock currently priced at ₹2,500. They want to sell the stock if the price drops below ₹2,000, but they don't want to sell it for less than ₹1,900. To do this, the investor sets a stop-limit order with a stop price of ₹2,000 and a limit price of ₹1,900.

If the stock price falls to ₹2,000, the stop order triggers, but the stock will only be sold if it can get at least ₹1,900 per share. If the price drops too quickly and falls below ₹1,900 before the order can be executed, the stock won’t be sold until it reaches ₹1,900 or higher.

In contrast, a regular stop order would sell the stock as soon as it hits ₹2,000, even if the price continues to fall rapidly and ends up selling for less. The stop-limit order gives the investor more control over the price, but there’s a chance the stock won’t sell if the limit price isn’t met.

A trailing stop order is a type of stop order that adjusts automatically based on the stock's price movement. Instead of setting a specific price, the trailing stop is based on a percentage change from the stock's highest price. This helps protect profits while allowing the stock to rise in value. If the stock's price falls by the set percentage, the order is triggered and the stock is sold.

Example for a Long Position:

Imagine an investor buys a stock at ₹1,000 and sets a trailing stop order with a 20% trail. If the stock price goes up to ₹1,200, the trailing stop will automatically move up to ₹960 (20% below ₹1,200). If the stock price then drops to ₹960 or lower, the trailing stop order will trigger, and the stock will be sold.

Example for a Short Position:

If an investor has shorted a stock at ₹1,000 and sets a trailing stop of 10%, the stop price would move down as the stock price falls. If the stock price rises by 10% from its lowest point, the trailing stop order will trigger, and the stock will be bought to cover the short position.

The trailing stop order allows the investor to lock in gains as the stock price moves favorably, while still providing protection if the market turns.

An Immediate or Cancel (IOC) order is a type of stock order that must be executed immediately. If the full order cannot be filled right away, whatever portion can be filled will be completed, and the rest will be canceled. If no part of the order can be executed immediately, the entire order is canceled.

Example:

Suppose an investor places an IOC order to buy 500 shares of a stock at ₹1,000 per share. If only 300 shares are available at ₹1,000 right away, the IOC order will purchase those 300 shares, and the remaining 200 shares will be canceled. If no shares are available at ₹1,000 immediately, the entire order will be canceled.

A Good Till Cancelled (GTC) order is a type of stock order that stays active until you choose to cancel it. Unlike other orders that expire at the end of the trading day, a GTC order remains open until you either cancel it or it gets executed. However, most brokerages set a limit on how long you can keep a GTC order open, usually up to 90 days.

Example:

Let's say an investor wants to buy a stock at ₹500, but the current price is ₹600. They place a GTC order to buy 100 shares at ₹500. This order will stay active until the stock price drops to ₹500 and the order is filled, or until the investor cancels the order. If the price never drops to ₹500 and the investor doesn't cancel the order, it will automatically expire after 90 days (or whatever time limit the brokerage sets).

A Good 'Till Triggered (GTT) order is similar to a Good 'Til Canceled (GTC) order but with a key difference: a GTT order only becomes active when a specified trigger condition is met. Once the trigger price is reached, the order is placed in the market. If the trigger price is not reached, the order stays inactive.

Example:

Imagine an investor wants to buy a stock currently priced at ₹600, but only if it drops to ₹550. They set a GTT order with a trigger price of ₹550. If the stock price falls to ₹550, the order is activated and placed in the market. If the price never drops to ₹550, the order remains inactive until it reaches the trigger price or the investor cancels it.

GTT orders can also have a time limit, so if the trigger price isn’t reached within a certain period, the order will expire.

In the stock market, an order is a fundamental instruction to buy or sell a security, tailored to an investor's strategy and market conditions. The various types of orders—such as market, limit, stop, stop-limit, trailing stop, IOC, GTC, and GTT—offer flexibility to manage price, timing, and risk. Understanding these order types empowers investors to execute trades more effectively, ensuring alignment with their financial goals and risk tolerance.

Learn how to optimize your trades and manage risk with Swastika!

Trust Our Expert Picks

for Your Investments!