Blog Title:

Tax Loss Harvesting Explained: How to Save on Capital Gains Legally

Investing in the stock market or mutual funds often brings profits—but also tax implications. For Indian investors, capital gains tax can eat into returns if not managed smartly. One powerful yet underutilized strategy is tax loss harvesting. Let’s explore how it works, its benefits, and how platforms like Swastika Investmart can help you implement it efficiently.

Tax loss harvesting is the practice of selling financial assets, such as stocks or mutual funds, that have declined in value to realize a loss. This loss can then be used to offset capital gains from other profitable investments. Essentially, you are converting paper losses into tax savings, all within the legal framework provided by the Income Tax Act of India.

For example, suppose you bought 100 shares of a stock at ₹1,500 each, and the current market price drops to ₹1,200. Selling these shares would lock in a ₹30,000 loss (100 x ₹300). This loss can then offset gains made elsewhere in your portfolio, reducing your taxable capital gains.

In India, capital gains are categorized into short-term and long-term:

By strategically realizing losses, investors can reduce the taxable amount, ensuring they pay only what is legally required.

Consider an investor, Ramesh, who has the following portfolio:

Ramesh can sell Stock B to realize the ₹20,000 loss, which offsets part of the gains from Stock A and Mutual Fund C. His net taxable gain becomes ₹60,000 instead of ₹80,000, effectively saving on taxes.

Platforms like Swastika Investmart allow investors to track such opportunities seamlessly using their research tools and portfolio analytics, helping make informed decisions without compromising long-term growth.

While tax loss harvesting is beneficial, investors must follow certain Indian regulatory guidelines:

Swastika Investmart, a SEBI-registered broker, offers tools and guidance to optimize tax loss harvesting strategies:

By integrating these features, Swastika Investmart ensures investors maximize tax efficiency without compromising portfolio health.

1. Can tax loss harvesting be applied to mutual funds in India?

Yes, both equity and debt mutual funds are eligible for tax loss harvesting, following short-term and long-term capital gains rules.

2. How often should I practice tax loss harvesting?

Ideally, review your portfolio annually or during major market corrections to identify potential losses to realize.

3. Will selling assets for tax benefits impact my long-term growth?

If done strategically, tax loss harvesting can reduce taxes without significantly affecting long-term returns. Planning and re-investment are key.

4. Is tax loss harvesting legal in India?

Absolutely. It is a completely legal strategy governed by the Income Tax Act, provided guidelines such as avoiding wash sales are followed.

5. Can I offset short-term and long-term gains differently?

Yes, losses can first offset gains of the same type (short-term against short-term, long-term against long-term) and any remaining losses can be carried forward for up to 8 years.

Tax loss harvesting is a smart, legal, and strategic tool for reducing capital gains tax in India. By carefully planning and executing this strategy, investors can improve portfolio efficiency and retain more wealth. Platforms like Swastika Investmart make it easy with SEBI-registered safety, strong research tools, and tech-enabled portfolio management.

Start leveraging tax-efficient investing today by opening an account with Swastika Investmart:

Blog Title:

Tax Loss Harvesting Explained: How to Save on Capital Gains Legally

Investing in the stock market or mutual funds often brings profits—but also tax implications. For Indian investors, capital gains tax can eat into returns if not managed smartly. One powerful yet underutilized strategy is tax loss harvesting. Let’s explore how it works, its benefits, and how platforms like Swastika Investmart can help you implement it efficiently.

Tax loss harvesting is the practice of selling financial assets, such as stocks or mutual funds, that have declined in value to realize a loss. This loss can then be used to offset capital gains from other profitable investments. Essentially, you are converting paper losses into tax savings, all within the legal framework provided by the Income Tax Act of India.

For example, suppose you bought 100 shares of a stock at ₹1,500 each, and the current market price drops to ₹1,200. Selling these shares would lock in a ₹30,000 loss (100 x ₹300). This loss can then offset gains made elsewhere in your portfolio, reducing your taxable capital gains.

In India, capital gains are categorized into short-term and long-term:

By strategically realizing losses, investors can reduce the taxable amount, ensuring they pay only what is legally required.

Consider an investor, Ramesh, who has the following portfolio:

Ramesh can sell Stock B to realize the ₹20,000 loss, which offsets part of the gains from Stock A and Mutual Fund C. His net taxable gain becomes ₹60,000 instead of ₹80,000, effectively saving on taxes.

Platforms like Swastika Investmart allow investors to track such opportunities seamlessly using their research tools and portfolio analytics, helping make informed decisions without compromising long-term growth.

While tax loss harvesting is beneficial, investors must follow certain Indian regulatory guidelines:

Swastika Investmart, a SEBI-registered broker, offers tools and guidance to optimize tax loss harvesting strategies:

By integrating these features, Swastika Investmart ensures investors maximize tax efficiency without compromising portfolio health.

1. Can tax loss harvesting be applied to mutual funds in India?

Yes, both equity and debt mutual funds are eligible for tax loss harvesting, following short-term and long-term capital gains rules.

2. How often should I practice tax loss harvesting?

Ideally, review your portfolio annually or during major market corrections to identify potential losses to realize.

3. Will selling assets for tax benefits impact my long-term growth?

If done strategically, tax loss harvesting can reduce taxes without significantly affecting long-term returns. Planning and re-investment are key.

4. Is tax loss harvesting legal in India?

Absolutely. It is a completely legal strategy governed by the Income Tax Act, provided guidelines such as avoiding wash sales are followed.

5. Can I offset short-term and long-term gains differently?

Yes, losses can first offset gains of the same type (short-term against short-term, long-term against long-term) and any remaining losses can be carried forward for up to 8 years.

Tax loss harvesting is a smart, legal, and strategic tool for reducing capital gains tax in India. By carefully planning and executing this strategy, investors can improve portfolio efficiency and retain more wealth. Platforms like Swastika Investmart make it easy with SEBI-registered safety, strong research tools, and tech-enabled portfolio management.

Start leveraging tax-efficient investing today by opening an account with Swastika Investmart:

• Short term capital gains on stocks are taxed at 15 percent if shares are sold within one year.

• Long term capital gains above ₹1 lakh are taxed at 10 percent when stocks are held for more than one year.

• Proper tax planning can significantly improve long term investment returns.

• Understanding LTCG and STCG rules is essential for equity investors in India.

For many investors, the focus while investing in stocks is usually on returns. But taxation plays an equally important role in determining how much profit you actually keep. In India, capital gains from stocks are classified into two categories. These are short term capital gains (STCG) and long term capital gains (LTCG).

Understanding the difference between LTCG vs STCG on stocks in India can help investors plan their trades more efficiently and avoid surprises during tax filing.

Let’s break down how these tax rules work and what they mean for investors.

Whenever you sell a stock for a price higher than your purchase cost, the profit you earn is called a capital gain. The tax treatment of that gain depends mainly on the holding period of the stock.

If the stock is sold within one year of purchase, it falls under short term capital gains. If the holding period exceeds one year, the gain is considered long term.

These tax rules apply to equity shares listed on recognized stock exchanges in India where Securities Transaction Tax has been paid.

Short term capital gains arise when equity shares are sold within twelve months from the purchase date.

Under Section 111A of the Income Tax Act, short term capital gains on listed equities are taxed at 15 percent plus applicable surcharge and cess.

Suppose an investor buys shares of a company worth ₹2 lakh and sells them after six months for ₹2.5 lakh.

Profit earned: ₹50,000

Tax at 15 percent: ₹7,500

This tax is payable irrespective of the investor’s income tax slab.

Short term trading strategies such as swing trading or momentum trading often fall under this category.

Long term capital gains arise when listed equity shares are held for more than one year before selling.

Long term capital gains on equities are taxed at 10 percent without indexation, but only on gains exceeding ₹1 lakh in a financial year.

Imagine an investor purchases shares worth ₹3 lakh and sells them after two years for ₹5 lakh.

Total profit: ₹2 lakh

Exemption limit: ₹1 lakh

Taxable gain: ₹1 lakh

Tax payable at 10 percent: ₹10,000

This tax rule was introduced in the Union Budget 2018, replacing the earlier exemption on long term capital gains.

Short term capital gains apply when stocks are sold within one year. Long term capital gains apply when stocks are held for more than one year.

STCG is taxed at 15 percent, while LTCG is taxed at 10 percent on gains exceeding ₹1 lakh.

Long term investors enjoy a tax exemption on the first ₹1 lakh of gains each financial year, making long term investing more tax efficient.

Before 2018, long term gains on listed equities were completely tax free in India. However, the government introduced LTCG tax to ensure fair taxation and increase revenue from financial markets.

Despite this change, equities remain one of the most tax efficient investment options compared to several other asset classes.

For example, real estate gains can attract tax rates up to 20 percent with indexation benefits, while fixed deposits are taxed according to the investor’s income slab.

Understanding LTCG vs STCG on stocks in India can influence how investors structure their portfolios.

Investors who follow a buy and hold strategy often benefit from LTCG tax rules because they can take advantage of the ₹1 lakh exemption each year.

Short term traders frequently incur STCG tax on profits. While the tax rate is fixed at 15 percent, frequent trading can increase the overall tax burden.

Many investors plan their portfolio rebalancing after completing the one year holding period to reduce tax liability.

Consider two investors who buy shares of a large company listed on the NSE.

Investor A sells the stock after eight months and earns a ₹1 lakh profit. Since the holding period is less than a year, the profit is taxed as STCG at 15 percent.

Investor B holds the same stock for eighteen months and earns a ₹1.2 lakh profit. After applying the ₹1 lakh LTCG exemption, only ₹20,000 is taxable at 10 percent.

The difference in tax treatment significantly affects net returns.

Capital gains taxation on stocks falls under the Income Tax Act, while trading activities in the equity market are regulated by the Securities and Exchange Board of India (SEBI).

Stock exchanges such as the NSE and BSE ensure that securities transaction tax is collected during trades, which is a requirement for the applicable LTCG and STCG tax rules.

Understanding these regulatory aspects helps investors remain compliant and plan their investments efficiently.

Tax rules can influence investor behavior in financial markets.

Lower taxes on long term holdings encourage investors to remain invested for longer periods. This promotes stability in equity markets and reduces excessive speculation.

At the same time, a moderate STCG tax rate keeps active trading viable for market participants.

Overall, the balance between LTCG and STCG taxation supports both long term investment and market liquidity.

Investors can follow a few practical strategies to manage tax liability effectively.

Plan selling decisions carefully based on holding period.

Utilize the ₹1 lakh LTCG exemption every financial year.

Maintain proper records of purchase price and transaction statements.

Consult a tax advisor if you trade frequently or have multiple income sources.

A well planned approach can improve net investment returns over time.

Short term capital gains arise when stocks are sold within one year, while long term capital gains apply when stocks are held for more than one year.

Short term capital gains on listed equity shares are taxed at 15 percent under Section 111A of the Income Tax Act.

Long term capital gains above ₹1 lakh are taxed at 10 percent without indexation.

LTCG tax applies only when gains exceed ₹1 lakh in a financial year on listed equities where securities transaction tax has been paid.

No tax is payable on losses. However, capital losses can be carried forward and set off against future gains as per income tax rules.

Understanding LTCG vs STCG on stocks in India is essential for every investor who participates in the equity market. Taxes may seem like a small detail at first, but they can significantly influence overall investment returns.

By planning holding periods carefully and using available tax exemptions, investors can optimize their strategies and keep more of their profits.

If you want to invest in stocks with access to reliable research, advanced trading platforms, and investor education support, Swastika Investmart offers a SEBI registered platform designed to help investors make smarter financial decisions.

• IndiGo CEO Pieter Elbers has resigned, marking a major leadership transition at India’s largest airline.

• Leadership changes often trigger investor attention because strategy and expansion plans may evolve.

• IndiGo remains a dominant player in India’s fast growing aviation market.

• The transition could influence the airline’s growth strategy, fleet expansion, and international ambitions.

.webp)

Leadership transitions in large companies rarely go unnoticed. When the company in question is IndiGo, India’s largest airline by market share, the impact extends beyond the corporate boardroom and into financial markets.

The resignation of IndiGo CEO Pieter Elbers has sparked discussions among investors, aviation analysts, and market participants. While leadership changes are common in corporate life, they often signal the beginning of a new strategic phase.

For investors, the key question is straightforward. What does this change mean for IndiGo’s growth trajectory, the aviation sector, and the company’s stock performance?

Let’s examine the broader implications.

IndiGo has grown into one of the most successful aviation stories in India. Since its launch in 2006, the airline has built a reputation for operational efficiency, cost discipline, and punctual service.

Today, IndiGo commands over 60 percent of India’s domestic aviation market, making it the clear leader in the sector.

The airline’s business model focuses on:

• Low cost operations

• High aircraft utilization

• A strong domestic network

• Expanding international routes

This approach has helped IndiGo remain profitable in an industry known for volatile margins and high operating costs.

Pieter Elbers joined IndiGo as CEO after a long career with the Dutch airline KLM. His appointment brought global aviation experience to the Indian carrier.

During his tenure, IndiGo accelerated its international expansion plans and strengthened partnerships with global airlines.

Key developments during his leadership included:

• Expanding international routes across Asia and the Middle East

• Strengthening fleet expansion strategies

• Enhancing operational efficiency

His resignation therefore raises questions about the future leadership direction.

In the aviation industry, leadership decisions directly influence operational strategy and long term investments.

Airlines operate in a complex environment involving fuel price fluctuations, regulatory oversight, aircraft procurement, and global competition.

A new CEO may introduce changes in areas such as:

The airline may reconsider its expansion plans for international destinations or domestic connectivity.

Aircraft orders represent massive capital investments. Leadership changes can alter fleet planning priorities.

Airlines often collaborate with international carriers through codeshare agreements and alliances.

Because of these factors, investors often monitor leadership transitions closely.

For shareholders, leadership change can initially create uncertainty. However, the long term effect depends on the strategic direction taken by the company.

Stock markets typically respond quickly to major corporate announcements. Leadership transitions sometimes trigger short term volatility as investors assess potential changes in strategy.

IndiGo’s strong market position, large fleet, and brand reputation provide a solid foundation. The company continues to benefit from India’s rapidly growing aviation market.

India is expected to become one of the largest aviation markets globally over the next decade.

This structural growth trend supports long term demand for airlines.

India’s aviation industry has experienced remarkable growth in recent years.

Rising disposable incomes, improved connectivity, and expanding airport infrastructure have driven passenger traffic.

Government initiatives such as UDAN (Ude Desh ka Aam Nagrik) aim to improve regional connectivity and make air travel more accessible.

The Directorate General of Civil Aviation regulates the sector and ensures safety and operational compliance.

As air travel demand grows, airlines are expanding fleets and routes to capture new opportunities.

While IndiGo dominates the market, it faces competition from other carriers.

Key competitors include:

Air India

SpiceJet

Akasa Air

Vistara

Each airline follows a different strategy, ranging from full service international operations to low cost domestic models.

IndiGo’s strength lies in its operational efficiency and large network, which helps it maintain a leading position.

Despite strong growth prospects, airlines face several challenges.

Aviation turbine fuel is one of the largest cost components for airlines. Price volatility can significantly impact profitability.

Aircraft leasing and maintenance expenses are often denominated in US dollars, making airlines sensitive to currency movements.

Airports in major Indian cities are sometimes operating near capacity, which can affect scheduling and expansion plans.

Leadership decisions play a key role in navigating these challenges effectively.

History shows that leadership transitions can reshape airline strategies.

For example, several global airlines introduced aggressive expansion or restructuring programs after leadership changes.

Sometimes these changes unlock new growth opportunities. In other cases, companies focus on operational consolidation.

For IndiGo, the next leadership phase could determine how the airline approaches international expansion and fleet growth.

Investors should monitor several developments following the CEO resignation.

• Appointment of the new leadership team

• Strategic direction for international expansion

• Fleet acquisition plans

• Operational performance and profitability

These factors will help determine how IndiGo evolves in the coming years.

While leadership changes can occur for various reasons, the resignation marks a transition period for the airline as it prepares for its next phase of growth.

IndiGo is India’s largest airline by market share and plays a major role in domestic and international connectivity.

Leadership transitions can create short term market volatility, but long term performance depends on strategy and operational execution.

The Directorate General of Civil Aviation oversees aviation safety, operations, and regulatory compliance in India.

Airlines face challenges such as high fuel costs, currency fluctuations, intense competition, and infrastructure limitations.

The resignation of IndiGo CEO Pieter Elbers marks a significant moment for India’s aviation sector. Leadership transitions often bring new strategic perspectives that shape a company’s future direction.

Despite short term uncertainty, IndiGo remains a dominant force in India’s rapidly expanding aviation market. Investors will now focus on how the airline’s next leadership team approaches growth, competition, and operational efficiency.

For investors looking to track such market developments and make informed decisions, Swastika Investmart offers a SEBI registered platform with advanced research tools, technology driven trading systems, strong customer support, and investor education resources.

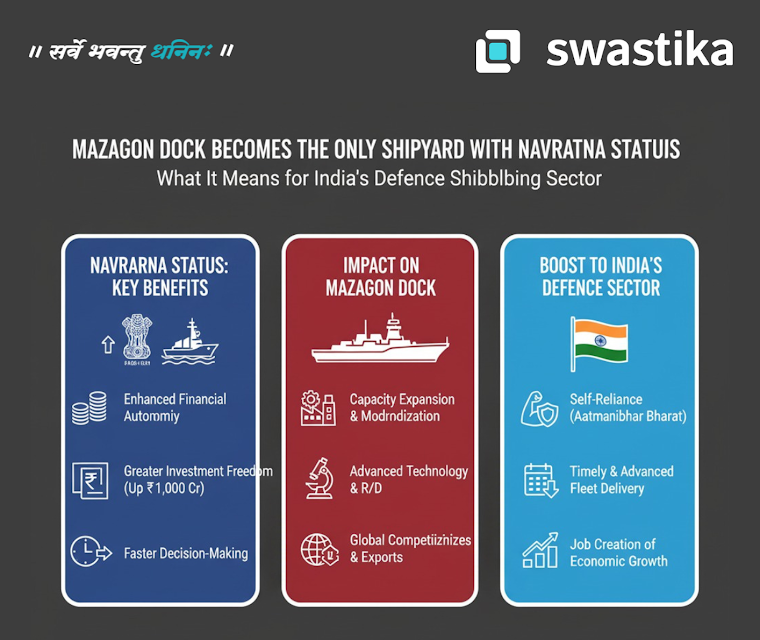

• Mazagon Dock Shipbuilders has received Navratna status, becoming the only Indian shipyard with this recognition.

• The status gives greater financial autonomy to take strategic investment decisions.

• It strengthens India’s defence manufacturing ecosystem under the Make in India initiative.

• Investors see the move as a long term positive for defence shipbuilding and related stocks.

India’s defence manufacturing ecosystem has been evolving rapidly over the past decade. With rising geopolitical uncertainties and the government’s strong push for self reliance in defence production, domestic shipyards are playing a crucial role.

In a significant development, Mazagon Dock Shipbuilders Limited (MDL) has been granted Navratna status, making it the only shipyard in India to receive this prestigious classification among public sector enterprises.

For investors and industry observers, this announcement goes beyond symbolism. Navratna status can reshape Mazagon Dock’s strategic flexibility, strengthen the defence shipbuilding ecosystem, and potentially influence the outlook for defence stocks in India.

Navratna status is awarded by the Government of India to high performing public sector enterprises that demonstrate strong financial performance and operational efficiency.

Companies with this designation receive greater autonomy in business decisions compared with regular central public sector enterprises.

Navratna companies can:

• Invest up to ₹1,000 crore or 15 percent of net worth in a single project without government approval

• Form joint ventures and strategic partnerships more easily

• Enter international markets and acquisitions with greater flexibility

This autonomy allows companies to act faster in competitive industries where quick investment decisions matter.

For a defence shipbuilder like Mazagon Dock, this flexibility can be especially valuable.

Mazagon Dock Shipbuilders Limited is one of India’s leading defence public sector undertakings engaged in building warships and submarines for the Indian Navy.

Headquartered in Mumbai, the company has decades of experience in complex naval platforms, including destroyers, frigates, and submarines.

Mazagon Dock has delivered several critical naval programs, including:

• Scorpene class submarines under Project 75

• Visakhapatnam class stealth destroyers under Project 15B

• Nilgiri class stealth frigates under Project 17A

These projects highlight the company’s technological capability in high value defence manufacturing.

The elevation of Mazagon Dock to Navratna status comes at a time when India is aggressively pushing for defence self reliance.

The government’s Atmanirbhar Bharat initiative aims to reduce dependence on defence imports and promote domestic production.

With greater financial autonomy, Mazagon Dock can approve investments more quickly. This could accelerate shipbuilding programs and infrastructure expansion.

Navratna status allows easier collaboration with international defence companies for technology transfer and joint ventures.

For example, submarine construction often requires advanced technology partnerships with global defence firms.

A stronger Mazagon Dock could create opportunities for suppliers, engineering companies, and defence component manufacturers across India.

Whenever a public sector enterprise receives a higher status classification, investors often view it as a sign of strong operational performance.

Mazagon Dock has already been one of the standout performers among defence stocks in recent years.

Navratna recognition reinforces investor confidence in the company’s financial strength and long term growth potential.

Mazagon Dock typically operates with a large order backlog from the Indian Navy. This provides strong revenue visibility for several years.

Defence shipbuilding is a strategic sector where government support is likely to remain strong.

Because of these factors, investors often consider companies like Mazagon Dock as long term plays on India’s defence modernization.

India is currently among the world’s largest defence importers, but the government is actively working to increase domestic manufacturing.

Several initiatives support this transition:

• Defence procurement policies prioritizing local production

• Production Linked Incentive programs for manufacturing

• Restrictions on importing certain defence equipment

In naval modernization, the Indian Navy has ambitious plans to expand its fleet of submarines, destroyers, and aircraft carriers.

This creates long term opportunities for domestic shipbuilders.

While Mazagon Dock is a key player, other Indian shipyards are also involved in defence shipbuilding.

Notable participants include:

Garden Reach Shipbuilders and Engineers

Cochin Shipyard Limited

Hindustan Shipyard Limited

Each company focuses on specific types of vessels and projects. However, Mazagon Dock’s submarine expertise gives it a unique strategic position within India’s defence manufacturing ecosystem.

Although Navratna status is positive, investors should track several factors going forward.

New defence contracts will play a major role in sustaining long term growth.

Large shipbuilding projects often span several years. Timely delivery is critical for maintaining profitability.

India is increasingly promoting defence exports. If Mazagon Dock secures international contracts, it could unlock additional revenue streams.

Several other public sector enterprises that received Navratna status earlier have expanded aggressively.

For example, companies in sectors such as power and engineering used the autonomy to invest in new projects and expand globally.

Mazagon Dock could follow a similar path by strengthening its shipbuilding infrastructure and exploring overseas defence collaborations.

Navratna status is a classification given by the Government of India to high performing public sector enterprises that meet specific financial and operational criteria.

Mazagon Dock becomes the only shipyard with Navratna recognition, giving it greater financial autonomy and strategic flexibility in defence shipbuilding.

The status could improve investor sentiment by reinforcing the company’s strong operational track record and growth potential in defence manufacturing.

Mazagon Dock builds advanced naval platforms such as submarines, destroyers, and stealth frigates for the Indian Navy.

The move strengthens domestic defence capabilities and aligns with the government’s Make in India and Atmanirbhar Bharat initiatives.

Mazagon Dock receiving Navratna status marks an important milestone for India’s defence shipbuilding sector. The recognition highlights the company’s strong operational capabilities and strategic importance in supporting the Indian Navy.

With greater financial autonomy and the government’s continued push for defence self reliance, Mazagon Dock could play an even bigger role in India’s maritime defence ecosystem.

For investors, developments in defence manufacturing present interesting opportunities, especially as India continues to expand its domestic defence industry.

If you want to stay ahead of such market opportunities, Swastika Investmart offers a SEBI registered platform with advanced research tools, technology driven trading systems, strong customer support, and investor education resources.

• Reliance Industries is reportedly exploring a massive $300 billion refinery project in the United States.

• The deal could strengthen Reliance’s position in global energy and refining markets.

• Investors are watching closely as the project may influence Reliance stock valuation and long term strategy.

• The move reflects Reliance’s ambition to expand beyond India and capture global energy demand.

Reliance Industries has never been a company that thinks small. From building the world’s largest refining complex in Jamnagar to transforming India’s telecom industry with Jio, the conglomerate has repeatedly taken bold strategic bets.

Now, reports about a potential $300 billion refinery project in the United States have sparked widespread interest among investors and energy market participants. If the deal materializes, it could become one of the largest energy infrastructure investments ever attempted by an Indian company abroad.

For investors, the key question is simple. What does this move mean for Reliance Industries’ stock, global energy markets, and Indian investors?

Let’s break it down.

The proposed refinery investment reportedly involves developing a large scale refining and petrochemical complex in the United States. Such projects typically involve massive capital expenditure, advanced refining technology, and long term supply agreements.

Reliance Industries already operates the Jamnagar refinery complex in Gujarat, which is widely considered the largest refining hub in the world. This facility processes crude oil and exports petroleum products across multiple continents.

Expanding into the US could allow Reliance to:

• Access North American energy markets

• Strengthen global refining capabilities

• Diversify revenue streams beyond India

It also reflects a broader strategy of positioning Reliance as a global energy and petrochemical powerhouse.

The United States remains one of the largest energy markets in the world. It also plays a critical role in global crude oil production and refining.

Investing in refining capacity within the US offers several advantages:

North America has strong demand for refined petroleum products such as gasoline, diesel, and jet fuel. Establishing local refining capacity allows companies to serve these markets more efficiently.

The US has become one of the world’s largest crude producers, especially due to shale oil production. A refinery located closer to production hubs can benefit from lower transportation costs.

Refineries in the US often export refined products to Latin America and Europe. This could help Reliance expand its global trading footprint.

Whenever Reliance Industries announces a large investment plan, the market response tends to be immediate. Investors closely track whether the move enhances long term earnings potential.

A large refinery project could strengthen Reliance’s leadership in the global energy sector. Investors may view this as a long term growth driver, particularly if the project delivers strong export revenues.

Reliance has historically demonstrated strong execution capabilities. The Jamnagar refinery is a prime example of how strategic investments can generate long term value.

At the same time, a $300 billion investment raises questions about capital allocation and project timelines.

Large infrastructure projects typically require years of construction, regulatory approvals, and financing arrangements. Investors may initially react cautiously until more clarity emerges regarding funding structure and expected returns.

If the project moves forward, it could influence refining dynamics worldwide.

A large refinery in the US could increase global refining capacity. This may affect margins for refining companies across Asia, Europe, and North America.

Major energy companies such as ExxonMobil, Chevron, and BP already operate extensive refining networks. Reliance entering the US refining landscape could intensify competition.

However, Reliance’s expertise in complex refining and petrochemicals could help it compete effectively in global markets.

Reliance Industries carries significant weight in India’s equity market. The company is among the largest constituents of benchmark indices such as the Nifty 50 and Sensex.

Because of this, any major development related to Reliance can influence overall market sentiment.

If investors interpret the deal as a strong long term growth opportunity, it could support Reliance’s stock performance and indirectly benefit benchmark indices.

The news also highlights India’s increasing role in global energy investments. This could improve investor perception toward Indian energy companies operating internationally.

Large overseas investments by Indian corporates demonstrate financial strength and strategic ambition. Such developments often attract global investor attention toward Indian markets.

Every large investment carries risks, and investors should evaluate them carefully.

Refinery projects require enormous upfront capital. Any delays or cost overruns could affect financial returns.

Global energy markets are gradually shifting toward renewable sources. Over the long term, refining demand may face structural changes.

Energy infrastructure projects in the US must comply with multiple regulatory and environmental requirements, which can extend project timelines.

Despite these challenges, Reliance has shown the ability to manage complex industrial projects successfully.

Reliance Industries has repeatedly demonstrated its ability to transform industries.

The company built the Jamnagar refinery complex, which processes over a million barrels of crude oil per day. It also disrupted the telecom market through Reliance Jio, which became one of the largest digital networks in India within a few years.

These examples show that Reliance is comfortable making large bets when it sees long term opportunity.

For investors, this track record often provides confidence that ambitious projects can eventually translate into shareholder value.

As more details emerge about the potential refinery project, investors should focus on several factors:

• Funding structure and partnerships

• Construction timeline and regulatory approvals

• Expected refining capacity and export markets

• Impact on Reliance’s balance sheet

Monitoring these factors will help investors assess whether the project strengthens Reliance’s long term earnings potential.

The proposal involves building a large scale refining and petrochemical complex in the United States, potentially worth around $300 billion.

If executed successfully, the project could strengthen Reliance’s global energy presence and support long term growth, although large capital investments may create short term market caution.

The US offers strong energy demand, proximity to crude oil production, and export opportunities to international markets.

Reliance Industries has significant weight in major indices. Any major strategic development can influence overall market sentiment.

Key risks include high capital expenditure, regulatory approvals, project execution timelines, and long term changes in global energy demand.

The potential $300 billion US refinery project by Reliance Industries reflects the company’s ambition to expand its influence in global energy markets. While the scale of the investment is massive, Reliance’s history of executing large projects gives investors reason to watch developments closely.

For long term investors, the key lies in understanding how such strategic moves can shape the company’s future earnings and market position.

If you are an investor looking to track market opportunities and invest with confidence, platforms like Swastika Investmart provide SEBI registered services, advanced research tools, technology driven trading platforms, and strong investor support.

Every few weeks, a new IPO lands on the radar and investors scramble to figure out if it's worth their money or just another listing day gamble. The Innovision IPO is one that's been generating quiet buzz in Mainboard market circles — and for good reason. Whether you're a seasoned IPO investor or someone who's just getting the hang of how primary markets work, this review will walk you through what matters before you hit that apply button.

Let's break it down properly.

Quick Summary

India’s IPO market has remained active with companies from diverse sectors tapping public markets for growth capital. The Innovision IPO is one such offering that has attracted attention due to its rapid revenue growth and diversified service portfolio.

Innovision Limited operates in manpower services, toll plaza management, and skill development training. While the company has shown strong financial growth in recent years, investors need to weigh its valuation and business model before subscribing.

In this Innovision IPO review, we break down the company’s business model, financials, risks, and overall outlook to help investors make an informed decision.

The Innovision IPO aims to raise funds primarily to reduce debt and support working capital needs.

Issue Open Date: March 10, 2026

Issue Close Date: March 12, 2026

Price Band: ₹521 to ₹548 per share

Lot Size: 27 shares

Face Value: ₹10 per share

Listing: BSE and NSE

Expected Listing Date: March 17, 2026

The IPO consists primarily of a fresh issue, and the funds will be used for:

• Repayment or prepayment of borrowings

• Funding working capital requirements

• General corporate purposes

These objectives suggest the company intends to strengthen its balance sheet and support operational expansion.

Innovision Limited started as a security service provider and gradually evolved into a diversified manpower and operational services company.

Today, the company operates across 23 states and 5 union territories in India, providing workforce solutions and operational management services to various sectors.

Manpower Services

Innovision deploys trained workforce for facility management, security services, and other operational roles for enterprises.

Toll Plaza Management

The company manages toll plaza operations under contracts, particularly linked with national highway infrastructure.

Skill Development Training

Innovision also offers training programs through partnerships with government bodies to develop skilled workforce for industries.

This multi segment approach allows the company to diversify revenue streams and tap into India's expanding infrastructure and services ecosystem.

Innovision has delivered strong revenue growth over the past three years.

FY23 Revenue: ₹257.62 crore

FY24 Revenue: ₹512.13 crore

FY25 Revenue: ₹895.95 crore

This growth reflects increasing demand for outsourced manpower and operational services across India.

FY23 Net Profit: ₹8.88 crore

FY24 Net Profit: ₹10.27 crore

FY25 Net Profit: ₹29.02 crore

The company’s Return on Net Worth (RoNW) stands at about 35.45 percent, which is significantly higher than many companies in similar service sectors.

However, the EBITDA margin is around 5.78 percent, highlighting the thin margin nature of manpower and facility management businesses.

Innovision competes with companies offering facility management and manpower outsourcing services.

Some listed peers in adjacent segments include:

Krystal Integrated Services

Updater Services

SIS Limited

Quess Corp

Highway Infrastructure

While these companies operate in similar spaces, Innovision’s niche lies in combining manpower deployment, toll management, and skill development.

Still, many competitors have larger scale and deeper client relationships, which investors should consider when evaluating long term prospects.

The company generates revenue from multiple verticals including manpower services, toll operations, and training programs.

Innovision works with organizations such as NSDC, MoRD, and NCVT, which adds credibility to its skill development initiatives.

Operating across most parts of India allows the company to tap into multiple infrastructure and services opportunities.

Having access to a trained workforce enables the company to quickly deploy manpower for large contracts.

A significant portion of revenue in the toll management segment depends on contracts with infrastructure authorities like NHAI.

With EBITDA margins around 5 to 6 percent, the business has limited room for profitability shocks.

Manpower intensive businesses often face high employee turnover, which increases recruitment and training costs.

Delays in statutory filings or compliance could attract penalties or operational disruptions.

At the upper price band, the company is valued at around 35.69 times its pre IPO earnings.

While the high RoNW of over 35 percent indicates efficient capital use, the valuation already factors in strong growth expectations.

For investors, this means the company will need to continue improving margins and expanding its service portfolio to justify the premium.

India’s infrastructure and outsourcing ecosystem has been growing rapidly due to government investments in highways, logistics, and urban development.

Companies offering manpower services, facility management, and operational outsourcing are expected to benefit from:

• Increased infrastructure projects

• Rising corporate outsourcing trends

• Government skill development initiatives

Innovision operates directly in these segments, which could provide long term growth opportunities if executed efficiently.

Innovision offers exposure to India’s growing manpower and infrastructure services sector. The company has shown impressive revenue growth and maintains a strong return on net worth.

However, investors must consider the thin margins and relatively high valuation before making a decision.

For risk tolerant investors with a long term view on outsourcing and infrastructure services, the IPO may offer growth potential. Conservative investors may prefer to track the company’s margin performance after listing.

Innovision provides manpower services, toll plaza management, and skill development training across India.

The IPO price band is ₹521 to ₹548 per share.

The expected listing date is March 17, 2026 on BSE and NSE.

Major risks include thin operating margins, dependence on toll management contracts, and manpower intensive operations.

The company’s revenue grew from about ₹258 crore in FY23 to nearly ₹896 crore in FY25, while net profit reached ₹29 crore in FY25.

The Innovision IPO presents an interesting opportunity in the manpower and infrastructure services segment. The company has demonstrated strong revenue growth and operates across multiple service verticals.

At the same time, investors should carefully assess the valuation and operational risks before applying.

For investors looking to participate in IPO opportunities and access research driven insights, Swastika Investmart offers a strong platform with SEBI registered services, advanced research tools, reliable customer support, and technology driven investing solutions.

Trust Our Expert Picks

for Your Investments!